- Summary:

- FTSE 100 trading 0.77% lower at 7,288.5 after renewed concerns on US-China trade tensions as Chinese officials cancelled the trip to farms in USA.

FTSE 100 trading 0.77% lower at 7,288.5 after renewed concerns on US-China trade tensions as Chinese officials cancelled the trip to farms in USA. On Brexit front investors attention turn to Supreme Court decision this week on the legality of parliament’s suspension by PM Johnson.

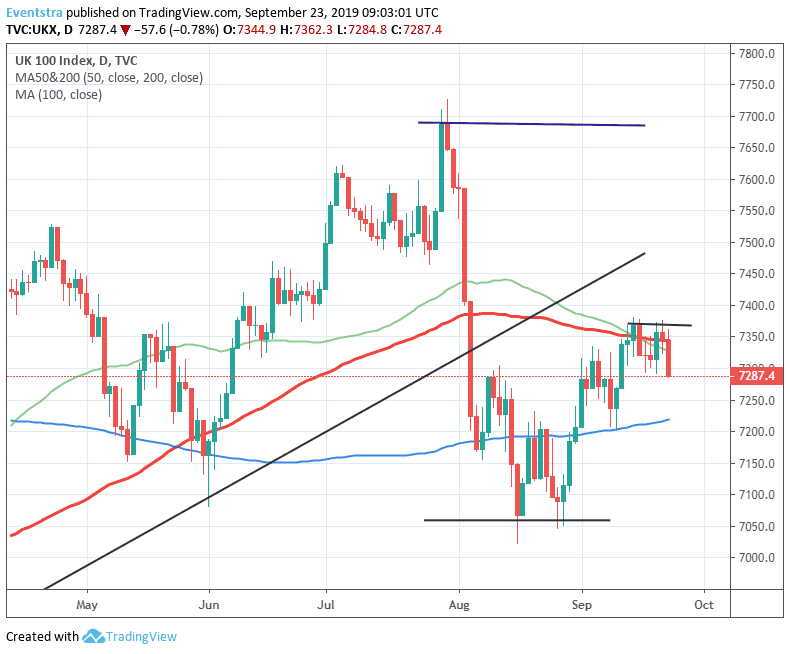

On the technical side FTSE 100 today breached the 100 and 200-day moving average cancelling the recent positive momentum. The index facing the resistance at 7,362 daily high and then at 7,404 the high from August 5th, a close above could open the way for a move up to 7,700 high, from end of July. On the downside, immediate support stands at 7,284 today’s low, while a break below will open the way for a test of 7,218 the 50-day moving average. More bids will emerge at 7,055 lows from August that the index rebounded twice.

European indices trading lower after worse than expected PMI’s, the DAX 30 gives up 1.51% to 12,279 while the CAC 40 in Paris trading 1.08% lower at 5,629, In Milan, the FTSE MIB is 1.17% lower at 21,863.

In Wall Street, the Dow Jones futures trading 0.26% lower at 26,815, the S&P 500 futures are 0.23% lower at 2,983 while the Nasdaq futures are 0.14% lower at 7,819 signalling a negative start for equities in the other side of the Atlantic.