- On the technical side FTSE 100 for one more day tested the 100 and 200-day moving average at 7,355 but rejected and as of writing the index touched the

FTSE 100 trading 0.14% lower at 7,334 close to monthly highs, as no-deal Brexit worries eased, while President Trump announced a 2-week delay in tariff hikes in $250 billion in Chinese imports and China announced that might also delay some US tariffs.

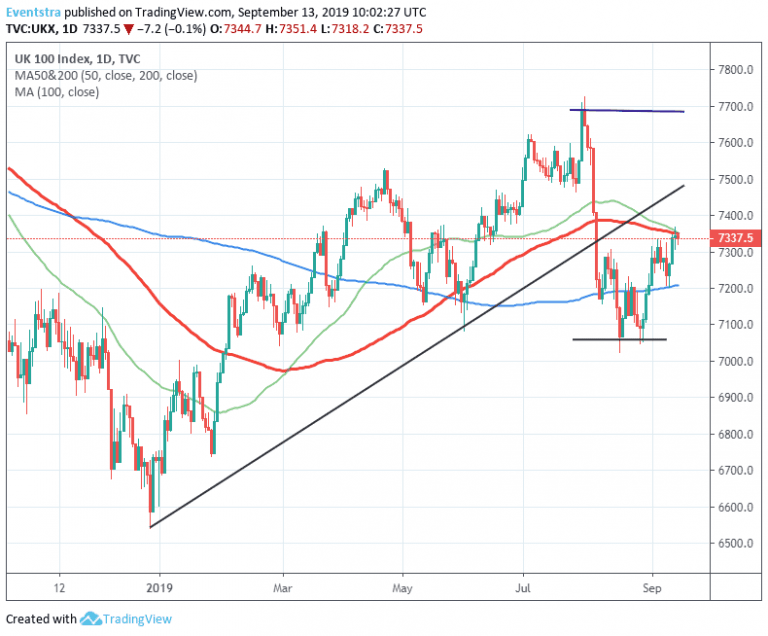

On the technical side FTSE 100 for one more day tested the 100 and 200-day moving average at 7,355 but rejected and as of writing the index touched the daily lows at 7,318. The index facing the resistance at 7,351 daily high and then at 7,404 the high from August 5th, a close above could open the way for a move up to 7,700 high from end of July. On the downside immediate support stands at 7,318 today’s low, while a break below will open the way for a test of 7,208 the 50-day moving average. More bids will emerge at 7,508 lows from August that the index rebounded twice.

European peers trading higher, the DAX 30 adds 0.27% to 12,443 while the CAC 40 in Paris trading 0.28% higher at 5,658, In Milan the FTSE MIB is 0.36% higher at 22,158.

In Wall Street, the Dow Jones futures trading 0.34% higher at 27,277, the S&P 500 futures are 0.25% higher at 3,021 while the Nasdaq futures are 0.29% higher at 7,965 signalling a positive start for equities in the other side of the Atlantic.