- Summary:

- USD/CAD trades near 1.4280 ahead of Canadian CPI data. Will inflation miss push the pair higher? Read more

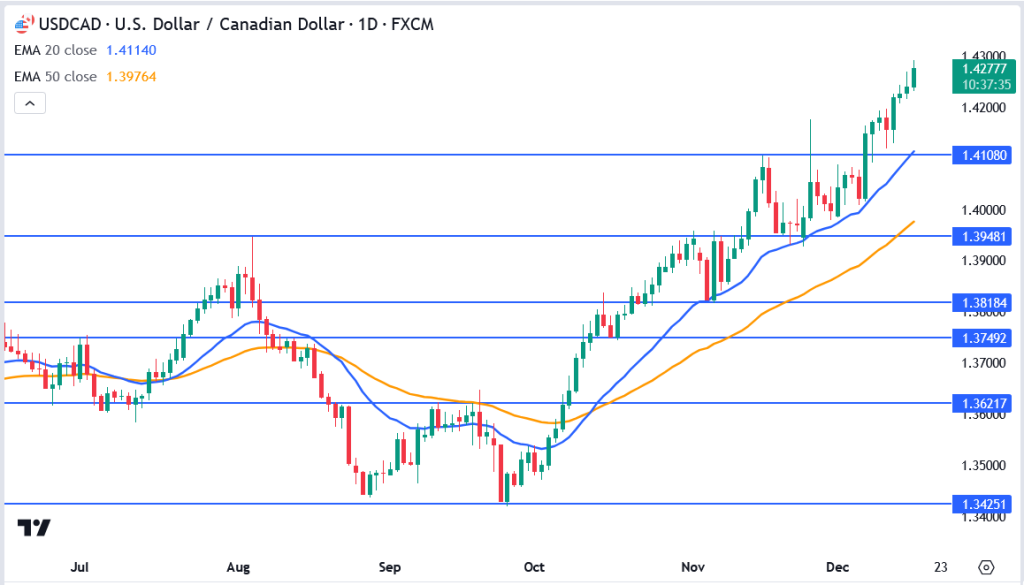

The USD/CAD pair is sitting just below 1.4280 as traders gear up for the Canadian CPI data later today. The pair has seen a steady push higher in recent sessions, helped along by broad U.S. dollar strength and weaker demand for the Canadian dollar.

Canadian CPI: The Market Driver

The inflation figures from Canada are poised to be a significant challenge for the loonie. Markets are anticipating a milder outcome, and should that occur, it will strengthen the belief that the Bank of Canada could shift to a more dovish stance in the near future. That might provide USD/CAD the boost necessary to surpass the 1.4300 level.

But if inflation surprises to the upside, we could see a bit of a shakeout. A stronger reading might give the loonie a short-term boost and drag the pair back toward 1.4100. However, with the U.S. dollar still well-supported, the broader trend remains hard to fight.

USD/CAD Chart Analysis

- Resistance:

- 1.4300: Immediate resistance; a break above this could signal further upside toward 1.4400.

- 1.4400: Psychological barrier and a potential upside target.

- Support:

- 1.4108: First line of defense for sellers.

- 1.4114: The 20-day EMA offers additional near-term support.

- 1.3976: Strong support at the 50-day EMA, aligning with the broader bullish trend.

- Momentum:

- Bullish momentum remains strong, with dips continuing to attract buyers.

- Trend:

- The pair stays firmly above its moving averages, reinforcing a clear upward trend.

Final Thoughts

USD/CAD is holding strong heading into today’s CPI data. If inflation disappoints, the loonie will likely struggle further, giving buyers the upper hand to push the pair higher. A hott