- Policy divergence is the core driver, as CNB maintains a cautious stance while the ECB leans toward gradual easing.

- Czech fundamentals remain resilient, with investment and exports supporting growth relative to the euro zone.

- Near-term rallies are likely to be capped, while the medium-term bias points to consolidation with mild downside risks.

Market Overview

EUR/CZK has mostly maintain a holding pattern through early 2026, hovering around the 24.30 level as traders straddle relatively robust Czech fundamentals and a euro hamstrung by softer growth, projections and expectations of linear monetary loosening from the ECB. The pair has been into itself, indicating a market that does not have a strong driver of directionality and appears instead anchored more by policy differentials rather than short-term risk sentiment.

And though the cross has seen sporadic assaults on more elevated prices, EUR/CZK has not held any meaningful break, which continues to highlight just how resilient the Czech koruna has been, even when measured it against the robust macro backdrop.

Central Banks: CNB Caution Vs ECB Easing Bias

Monetary Policy continues to underpin EUR/CZK. The Czech National Bank (CNB) has remained cautious and on hold at its last few meetings. Policymakers have stressed again and again that domestic sources of inflation pressures, especially in services and wage growth, remain intact. The CNB cautioned that “risks to inflation remains skewed to the upside”, and that there was limited demand for near-term rate cuts (Reuters, November 2025).

This approach is the opposite of the European Central Bank’s changing policy stance, although the ECB has not gone as far as to pledge a clear rate-reduction trajectory into the future, policymakers have gradually come round to seeing evidence of progress towards disinflation. One ECB policymaker reportedly said, “policy is tight, but it’s all about direction of travel and incoming data,” which markets took as further confirmation that the view for a glide path to easing through 2026 will remain in place.

The differential it creates still favored the koruna, providing a structural cap on EUR/CZK unless the CNB sends out clear signals of drastic changes to its policy stance.

Economic Fundamentals: Relative Strength in the Czech Economy

Data in the economy has held up relatively well. Investment flows and exports have been supportive, enabling the economy to absorb external headwinds from weaker euro zone demand and continuing trade uncertainties. As Reuters has pointed out, recent growth data indicate that the economy is “faring better than some of its regional peers,” despite patchy global circumstances (Reuters, May 2025).

The euro zone, by contrast, still grapples with the more tepid growth outlook. Confidence has been hit by structural issues, weak domestic demand and tighter fiscal conditions in some member states. These factors have eroded the euro’s appeal, and ability to outperform, particularly against other higher-yielding or fundamentally supported regional currencies such as the Czech koruna.

The contrast in growth momentum only serves to underline the picture that EUR/CZK is more than likely going to stay where it is (or maybe slightly lower) rather than markedly higher.

Price Action and Near-Term Dynamics

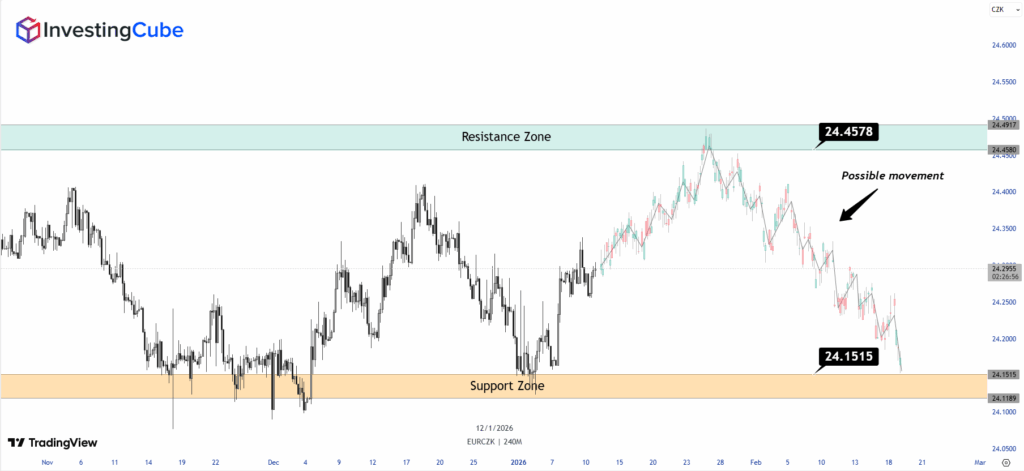

On a market structure basis, EUR/CZK is still very much ranged-bound. Recent price action has been held between approximately 24.15 and 24.45, with many failed attempts above and below these levels.

In the short term (1 to 4 weeks), sproadic attempts to push higher towards the range high can be overstated, especially if euro sentiment improves temporarily or global risk sentiment steadies. Without an obvious new policy surprise from the ECB or the CNB, such rallies are expected to be sold into and the cross contained within its wider range. Liquidity and the tamed nature of the pair also favor consolidation as opposed to an outright break.

Medium-Term Outlook: Consolidation With a Mild Downside Bias

For the next 3 to 6 months, we believe that the degree of risk is tilted towards a continuation of range trading with a mild downward bias in EUR/CZK. While the CNB retains it wary stance and inflation remains sticky, the koruna will have fundamental underpinning..

TradingEconomics forecast see EUR/CZK drifting slightly lower into the 24.10 to 24.20 area over the medium term, in line with a modestly stronger corona rather than a seismic trend change. Crucially, though this view is premised on no sudden worsening of Czech economic conditions and the ECB proving less hawkish than currently anticipated.

Risks to the Outlook

The key risk here are sharper-than-expected deterioration in Czech inflation that could re-open the door through which the CNB may ease, and a stronger euro due to firmer euro zone data or changes in ECB communication. External shocks, such as a sudden shift in global risk mood, could also create temporary volatility, although these are expected to prove short-lived unless backed by policy indications.

Conclusion

All in all, EUR/CZK is a stability trade guided by policy divergence and relative economic performance. Firming fundamentals of the Czech Republic and a watchful central bank are still balanced against euro uncertainties. Unless something substantially changes in inflation dynamics or central bank policy, the pair is likely to remain locked within a range. The pair looks well consolidated rather than pointing towards a fresh direction.

Frequently Asked Questions

The primary driver is the divergence between CNB and ECB monetary policy, particularly the interest rate differential supporting the koruna,

A sustained breakout appears unlikely without a major policy or macroeconomic surprise from either central bank.

A sharp decline in the Czech inflation prompting CNB easing, or a more hawkish-than-expected ECB shift, could alter the balance and push EUR/CZK out of its current range.