- Summary:

- Forex focus today will be the FOMC meeting later today as traders expect a 25 bps cut. In European session the UK August CPI figures and UK August PPI

Forex focus today will be the FOMC meeting later today as traders expect a 25 bps cut. In European session the UK August CPI figures and UK August PPI figures is due at 8:30GMT. In Eurozone the August final CPI figures and Eurozone July construction output data will be released at 9:00GMT.

In US forex calendar, the US MBA mortgage applications for the week 13 September is due at 11:00GMT while the Building Permits will bereleased at 15:30. The FOMC statement will be released at 21:00.

In Asian trading session the Australia Westpac Leading Index (month over month) down to -0.28% in August from previous 0.14%. New Zealand Current Account (quarter over quarter) came in at $-1.106B, topping forecasts of $-1.117B in 2Q 2019. The Japan Imports (year over year) came in at -12% below expectations of -11.2% in August. Japan Exports (year over year) came in at -8.2%, topping forecasts of -10.9% in August.

South Korea downgrades Japan trade status and tighter trade regulations will take effect immediately, Japan responded saying that the move is “regrettable”.

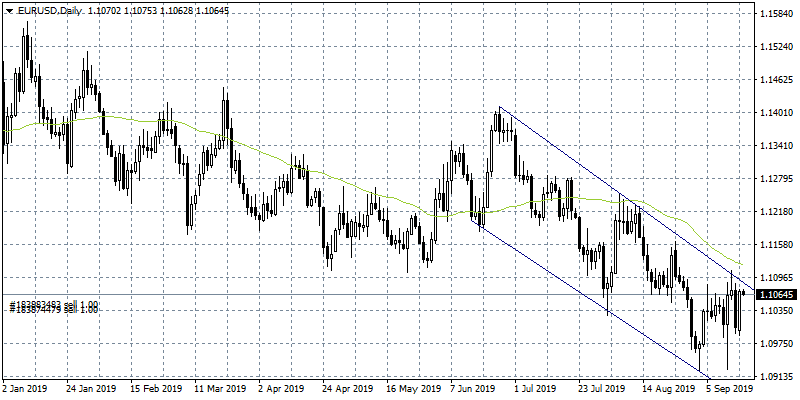

Asian indices are trading lower today, Nikkei giving up 0.16% at 21,965, the Hang Seng gives up 0.07% at 26,777. In forex EURUSD trades 0.04% lower at 1.1067; the USDJPY is 0.08% higher at 108.18 while the AUDUSD is 0.21% lower at 0.6850.

The central bank of China set the Yuan rate (USDCNY) at 7.0728 versus yesterday fix at 7.0730.