- Summary:

- EURUSD traders focus today is on ECB decision at 11:45GMT today. The European session starts with Germany August final CPI figures due at 6:00GMT

EURUSD traders focus today is on ECB decision at 11:45GMT today. The European session starts with Germany August final CPI figures due at 6:00GMT. The Switzerland August producer and import prices will be released at 6:30GMT. France August final CPI figures is due at 6:45GMT. The Eurozone July industrial production data is due at 9:00GMT.

In our central banks calendar, the central bank of Turkey (CBRT) announces its latest monetary policy decision at 11:00GMT. ECB will announce its latest monetary policy decision at 11:45GMT, the president Mario Draghi press conference will start at 12:30GMT.

In US forex calendar the US August CPI figures will be released at 12:30GMT alongside the weekly Initial Jobless Claims and Continuing Jobless Claims.

Japan Producer Price Index (month over month) came in at -0.3% below expectations of -0.2% in August; Actual Japan Producer Price Index (year over year) came in at -0.9%, below expectations -0.8% in August.

Japan Machinery Orders (YoY) came in at 0.3% above forecasts of -4.5% in July.

Japan Foreign Investment in Japan Stocks down to ¥-161.3B in September 6 from the previous ¥-89.5B. Japan Tertiary Industry Index (month over month) up to 0.1% in July from previous -0.1%

Australia Consumer Inflation Expectations fell from the previous 3.5% to 3.1% in September. The Singapore Retail Sales (YoY) up to -1.8% in July from previous -8.9% Singapore Unemployment rate remains unchanged at 2.2% in 2Q

New Zealand Food Price Index (month over month) came in at 0.7% in August from the previous 1.1%.

China M2 Money Supply (YoY) above forecasts (8.1%) in August: Actual (8.2%); China New Loans came in at 1210B, above forecasts of 1200B in August.

The central bank of China set the Yuan rate (USDCNY) at 7.0846 versus yesterday fix at 7.0843.

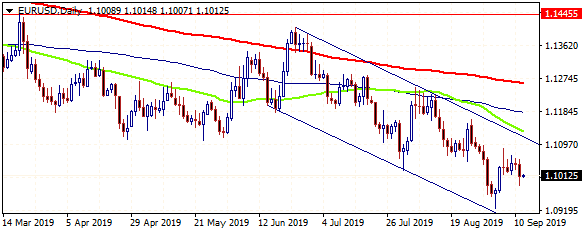

Asian indices are trading mostly higher today, Nikkei adding 0.99% at 21,812. EURUSD trades 0.01% higher at 1.1011; the USDJPY is 0.17% higher at 107.99 while the AUDUSD is 0.27% higher at 0.6880.