- Summary:

- For the Cineworld share price, the struggles seem not to have ended as the stock takes yet another dip this Tuesday.

The Cineworld share price resumed its downward move this Tuesday. The stock is down 1.48% and looks set to notch a third day of losses in four after failing to sustain the break of key resistance. The owner of the Regal Cinemas was able to secure a reprieve on a scheduled payment to former shareholders of the company it acquired some years back.

However, despite seeing record numbers of moviegoers at its cinemas for “Top Gun: Maverick” premiere, the stock could not sustain the initial enthusiasm that followed this film’s release. A Canadian court ruling against the company favouring Cineplex came with a C$1.23 billion price tag for damages.

However, this significant headwind can turn into a tailwind if Cineworld wins the appeal. With the Cineworld share price down 70% in the last year and 91% since its 2017 peak, it will take a major doing to shake off the bearish sentiment around the stock. Any rallies in the near term may provide short sellers with opportunities to force price action lower.

Cineworld Share Price Forecast

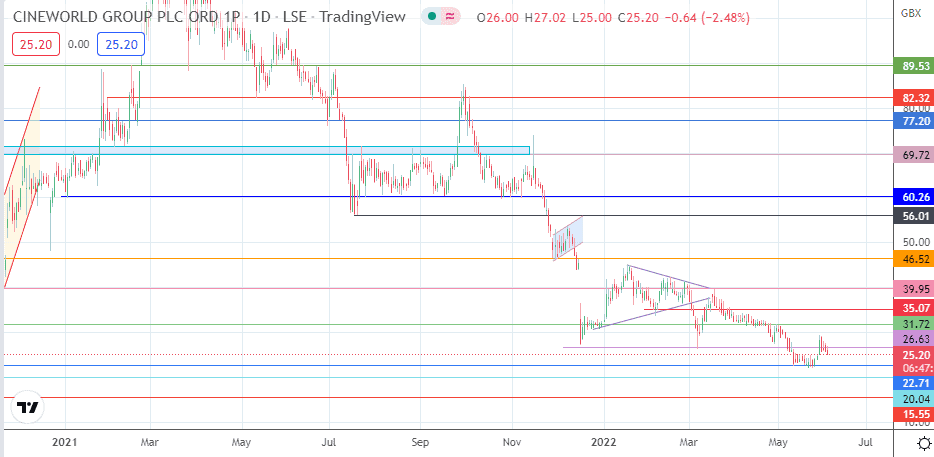

Following the symmetrical triangle’s breakdown, the price action eased to completion at the 22.71 price mark (former double bottom of 16 October/28 October 2021). The bounce violated the 26.63 resistance, but a failure to sustain the upside momentum caused this level to break down, with the price pushing towards a retest of the 22.71 support.

If the bulls fail to defend this support, the 18 March 2020 low at 20.04 becomes the next available target. Below this level, 15.55 (5 October 2020 low) forms an additional target to the south. On the other hand, the bulls need to force a break of 26.63 and overcome the 30 May high at 29.33 to open the door toward 31.72 (3 May high).

Above this level, an additional barrier is found at 35.07, the site of the previous high on 25 March. When this barrier is breached, the bulls will access the 39.95 and 46.52 (16 March) resistance targets. Attainment of the latter covers the 15 December 2021 bearish gap.

Cineworld: Daily Chart