- Summary:

- Here are the key quotes that we have collect from major banks across the globe about their expectations from Fed’s policy decision tomorrow:

Here are the key quotes that we have collect from major banks across the globe about their expectations from Fed’s policy decision tomorrow:

Nordea Markets: suggests that they doubt that the US Fed will be ready to cut its policy rates at today’s FOMC meeting but expect a clear signal of cuts ahead and a dot plot that supports the message.

“We expect the Fed to keep its key policy rates unchanged at 2.25-2.50% for the corridor and 2.35% for the interest on excess reserves (IOER). We expect clear signals of rate cuts ahead at Chair Powell’s press conference and expect the dot plot to support that message.”

“We changed our Fed forecast and now expect four rate cuts starting in July, though the Fed is not anywhere near that dovish yet.”

ABN AMRO: Dots to shift, but not aggressively

“Finally, we expect the quarterly ‘dot plot’ rate projections to signal a shift to easing.”

“As of the March projections, they continue to show one expected hike in 2020. At the very least, we expect this hike to be removed; more likely than not, one rate cut will be projected for this year or next”

ING: Fed to signal precautionary interest rate cuts are coming

“With trade tensions likely to escalate, this Wednesday’s Fed meeting looks set to confirm market expectations – precautionary interest rate cuts are coming,” argue ING analysts.

“After hiking interest rates four times in 2018 the Federal Reserve has taken a more cautious approach to monetary policy in 2019.”

“On Wednesday, we expect the Fed to signal precautionary rate cuts. Markets favor a 25bp rate cut in July with three additional rate cuts over the next twelve months.”

“We are a little more cautious seeing two 25bp moves in the second half of 2019, given the underlying strength of the US economy and our belief that President Trump will want a trade deal signed well ahead of the presidential elections next year.”

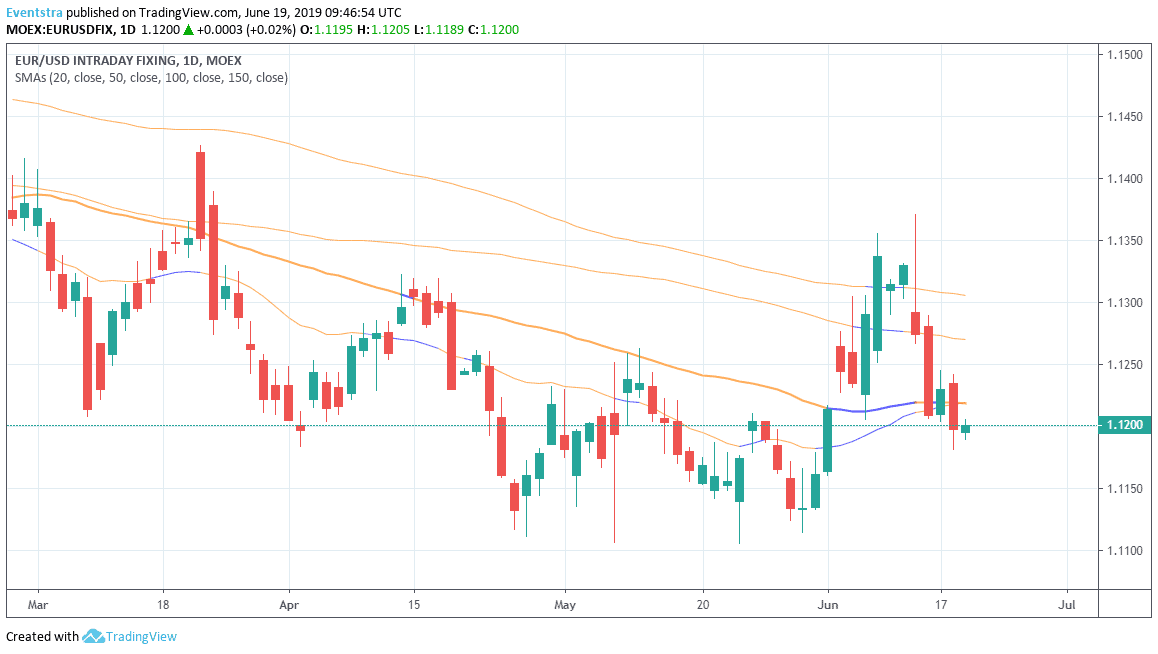

DANSKE BANK: “At the FOMC meeting tonight we look for the Fed to open the door for a rate cut in July and a total of 75bp cuts in H2. Lower inflation expectations, trade war uncertainty and signs of a manufacturing recession, point to the need for a lower Fed funds rate. It is crunch time for the ECB and the Fed and we stick to our call for EUR/USD to rise to 1.15 in 3M as the Fed is set to ‘out-ease’ the ECB.”

MORGAN STANLEY: “Dovish FOMC may focus on falling inflation expectations – In light of rapidly falling inflation expectations, the Fed is likely to keep the door to a summer rate cut open. US retail sales strength encourages investors to talk about a mid-cycle rate cut, which would be risk-positive.”

Deutsche Bank: “Friday’s strong retail sales data (more later) adds to the complexity. It’s hard not to feel that they are being driven into a corner at the moment as markets are now pricing in virtually a full rate cut at the July meeting and a further 2 cuts over the next 12 months.”

“Expectations are much lower for a cut this week, with around an 18% chance. Our US economists recently changed their Fed call and expect 3 cuts of 25bps each at the July, September and December meetings. They also lowered their 2019 growth forecast by 40bps to 1.9%.”

So all eyes on FED at 18:00GMT!