- Summary:

- The US Federal Reserve will round off its FOMC monetary policy meeting today with a decisionn on its key interest. Her are the possible rate cut scenarios.

Today at 6pm UTC, the U.S. Federal Reserve will release their new interest rate figure. The highlights of today’s news release will be as follows:

Interest rate decision: The markets are pricing in a 100% possibility of a rate cut, and the expectation is that the US Federal Reserve will cut rates by 25 bps. US President Donald Trump has been a leading advocate for something more aggressive.

The monetary policy statement: If there is a statement after the figure is announced, markets participants would be looking at the wording of this statement to pick any hints of future monetary policy direction. Focus would be on comments made about employment and inflation, which are the two fundamentals the Fed relies on to fashion out its monetary policy. US Federal Reserve Chairman Jerome Powell will likely to asked questions around future rate cuts. His answers will be interesting.

Will the FOMC Cut By 25bps or 50bps?

This is a key question that will determine market response on several USD-denominated assets today. The last few data releases for the US have been particular strong, and these may allow the Fed to get away with a 25bps rate cut. However, lower inflation remains a concern, as is the global economic outlook which is forecasted all around the world to be weaker.

After a series of hikes, the US Federal Reserve has softened its stance and is projecting two rate cuts in 2019. So the markets want to know if the US Fed Reserve will cut by 25bps in this meeting and a subsequent one, or will simply take a huge swipe by cutting 50bps as the US President is pushing for.

Trade Plays

If the Fed cuts by 50bps, this will be highly USD-negative and we will also expect to see safe haven plays in gold and the Swiss Franc. We could also see USD selling if a 25bps rate cut is followed by a statement that indicates future rate cuts that could come pretty soon after this one.

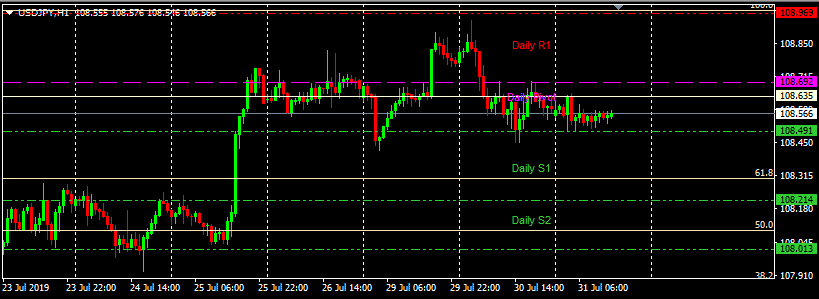

The markets have already priced in a 25bps cut. This may lead to muted reactions, or could present choppy market movement on USD pairs.Don’t miss a beat! Follow us on Twitter.