- Summary:

- The FOMC minutes indicated difference in opinion as to the direction of monetary policy, with 2 members proposing a 50bps cut.

The minutes of the last FOMC meeting held on July 31, 2019 can best be described as largely uneventful, with the exception that the tone of the document suggests that the Fed did not plan on further rate cuts in 2019. But as we know, economic conditions are highly dynamic and a lot has changed since the last FOMC meeting. The US-China trade war has escalated somewhat, and economic conditions in Europe, China and many other regions have deteriorated, with many central banks already implementing/mulling stimulus packages. These events may yet force the FOMC into further action in 2019.

The minutes indicate that the 12-member Federal Open Market Committee (FOMC) were divided on the monetary policy direction. Differences in opinion bordered mostly on the pace and direction of inflationary trends within the US, prompting two members to propose a more aggressive 50bps rate cut.

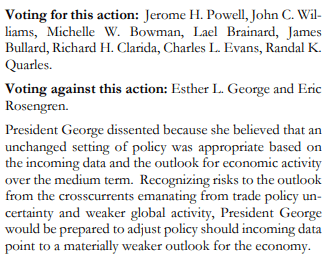

Two members did not want any rate cuts at all. Eric S. Rosengren and Esther L. George preferred to keep the target range of the interest rate at 2.25 – 2.50%. Rosengren’s reasons for dissension were elevated financial stability concerns, an unemployment rate that was at 50-year lows and his belief that inflation would track towards the Fed’s 2% target. Esther George believed that the incoming data available to the committee and the medium-term economic outlook supported retaining the FFR at the present rate.

The rest of the committee, including Fed Chair Jerome Powell and Vice Chair John C. Williams all voted to adjust the Federal Funds Rate downwards by 25bps. The minutes also noted that this reduction would be viewed as a mid-cycle adjustment and not the commencement of an aggressive round of easing. It also noted that any further adjustments would be made considering its symmetric 2% inflation targets as well as its maximum employment objectives.

In other words, the minutes reflected the statements of Fed Chief Jerome Powell at the post-announcement press conference, which left proponents of additional rate cuts disappointed and led to USD demand buying across board.