The US Federal Reserve has cut interest rates for the first time in a decade by 25bps. The Federal Funds Rate now stands at 2.25%. More interestingly, the Fed seems to have provided an indication that it will probably put a hold on further rate cuts while it studies the global economic situation more closely.

The market had largely priced in the Fed’s move. However, investors were divided between those who felt that the FOMC would take easing action just once, and those who suggested that this would be the first rate cut out of several to occur down the road. Of course, there was President Trump who felt that anything short of a more aggressive cut would be an under-delivery of the easing policy.

Among possible factors influencing the decision are a slew of positive data in the last week which include lower inflation, stronger than expected GDP readings and strong consumer confidence.

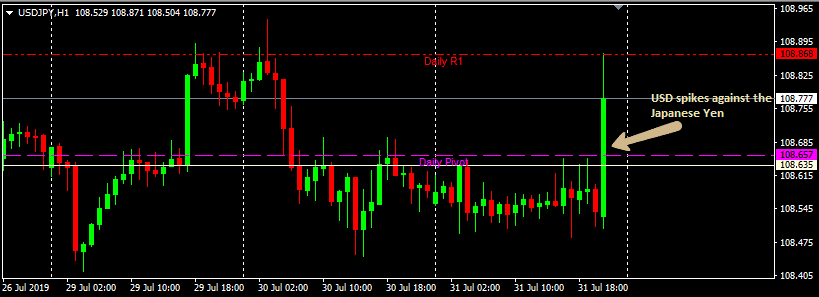

Market Response to FOMC Decision

The US Dollar has spiked across board, gaining on the Japanese Yen, Euro, Swiss Franc and British Pound. The response has been strongest on the USDJPY and USDCHF currency pairs.

It is likely that the Aussie Dollar and New Zealand Dollar will also weaken further when the Asian market opens for business.Don’t miss a beat! Follow us on Twitter.