- Summary:

- A look at the Fetch.ai price prediction 2022,2025 and 2030 indicates that this is a viable project that will pay off in the long-term.

Table of Contents

Fetch.ai is a lab-based artificial intelligence company that is also active in digital economics. The company has a platform that uses the blockchain to provide machine learning as an AI-based solution to automate functions within an ecosystem. In other words, the company believes that economic activity across several sectors can be automated using its machine-learning models, creating a unique, decentralized economic system that deploys FET as the reward system/currency of the ecosystem.

The Fetch.ai Price Prediction platform uses a modified version of the Tendermint Proof-of-Stake (PoS) consensus algorithm as its network security mechanism. The platform’s reward system for the successful generation of a block is the Fetch.AI Coin (FET).

Table of contents

Fetch.ai Coin Founders

Fetch.ai was founded in 2017 by Humayun Sheikh, Thomas Hain and Toby Simpson. Humayan Sheikh was a founding investor in DeepMind, a UK-based AI laboratory sold to Google. He brought his AI background to bear on the Fetch.ai project.

Fetch.ai Road Map

The company was launched in 2017 as a merger of uVue and itzMe.ai. By January 2018, the genesis block of the FET token was mined. In April of the same year, Fetch.ai published its white paper. In addition, the company sponsored the 4th Annual Wireless Technology Conference of the University of Cambridge’s Computer Lab. This event helped the company gain some public attention.

2019 brought with it the launch of the Mainnet. In July 2019, the project released the Antilla blockchain platform. By October 2019, the first trades on the decentralized metals exchange took place.

2020 saw the release of the Collective Learning framework. By 2021, Festo announced it would use the autonomous agent technology of Fetch.ai as the benchmark for its quality control in its manufacturing processes. A month later, the second version of the Mainnet was launched. By April, the company announced a collaboration with the Catena-X Automotive Network.

In late December 2021, CEO Humayun Sheikh announced the project’s 2022 roadmap, indicating it would start deploying its deep parking use cases and launch its social media network in 2022. In addition, Sheikh has said that the company is pushing several firms to adopt the smart parking system, which was successfully demonstrated at the IAA Global Mobility Conference in 2021.

Fetch.ai’s Adoption Statistics

The Fetch.ai blockchain platform is seeing steady institutional adoption. Esports entity Immortals partnered with Fetch.ai for a one-year campaign to expand its reach to its viewers, targeting those interested in cryptos using the Team Fetch.ai campaign.

In January 2022, Indacoin became the latest to join the train, signing a partnership agreement with Fetch.ai to quickly enable users to buy FET tokens with their bank cards. Fetch.ai CEO Humayun Sheikh hailed this move and said Indacoin would be a great partner in its mass adoption plans.

Fetch.ai has also integrated Chainlink into its network, coupling its data with its autonomous software. This is expected to enable Fetch.ai’s independent software agents to gain access to clients and projects on the Oracle-based platform that Chainlink offers.

Fetch.ai Price Prediction 2022

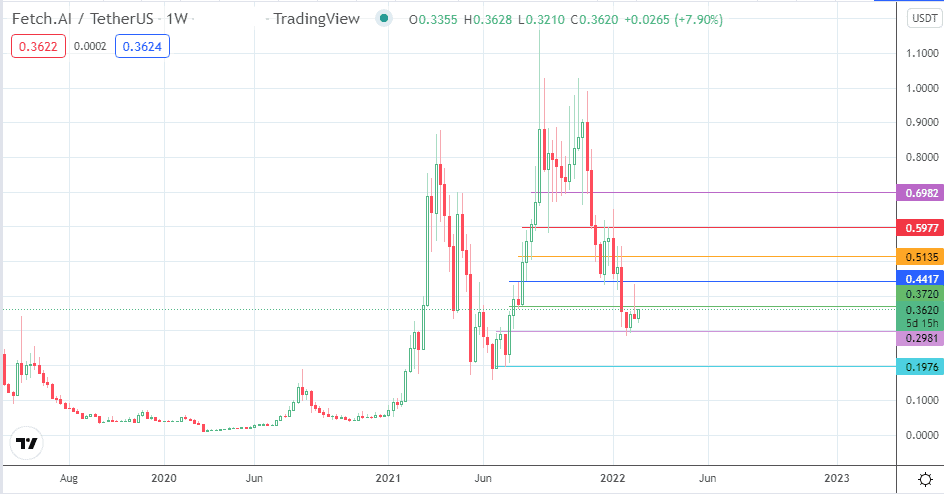

The Fetch.ai price prediction 2022 indicates a positive outlook for Fetch.ai. The recent price correction from the September/November 2021 double top has played out with completing the measured move at the 0.2981 support. So far, the price has remained within the range bordered by this support level and the 0.3720 resistance. A recent attempt at a breakout was unsuccessful.

The recent weekly candle has shown an 8% uptick. However, if the price activity takes out sequential barriers at 0.3720, 0.4417, and 0.5135, it rekindles hopes of a bullish Fetch.ai price prediction 2022 outlook. A run beyond the $1 mark may be ambitious in the short term, with 0.7 serving as a potential short-term price cap. However, if the price activity deteriorates and takes out 0.2981, we could see 0.1976 becoming a new target, making the road to short-term recovery longer.

Fetch.ai Price Prediction 2025

Realistically speaking, the Fetch.ai price prediction 2025 outlook looks more promising. This is because market recovery should have occurred largely by then, and the company’s AI-driven products would have achieved more mainstream adoption.

Suppose the price action has recovered above 0.6982 in the three years preceding 2025. In that case, we can expect that the bulls will drive prices above the 1.000 psychological price resistance, opening the door for a future advance towards the 6 September high at 1.1985.

If the price has been unable to breach the sequential barriers mentioned in the 2022 outlook, it may make the journey towards 1.0000 harder for the bulls.

Is Fetch.ai a good investment?

Fetch.ai is a good investment for the medium-term and long-term, principally because it has use cases that are highly scalable and can be monetized over time.

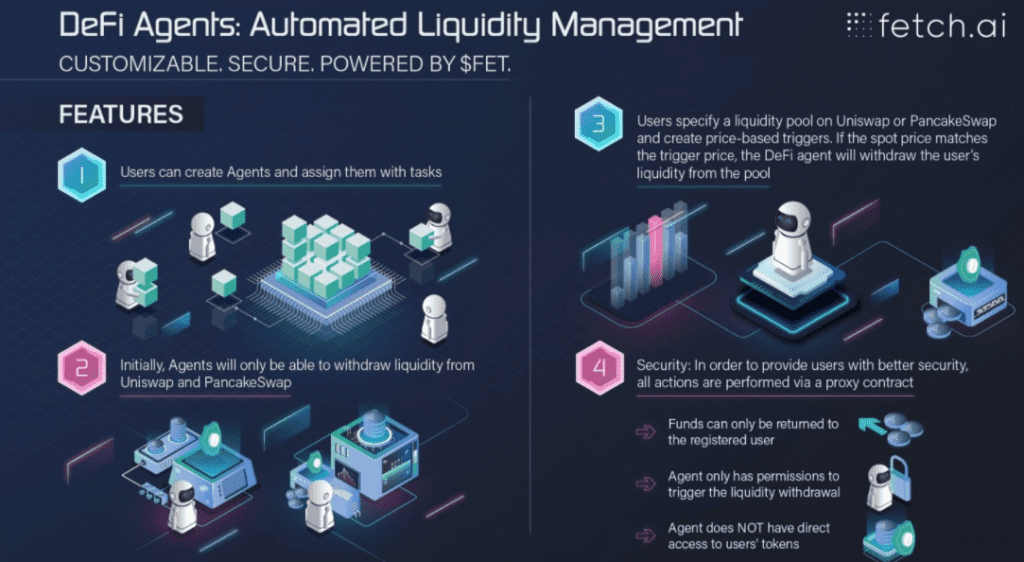

In an earlier article on this site, I pointed out how Fetch.ai had developed a solution to counter the impermanent losses suffered by traders on DeFi platforms through the autonomous action of its DeFi agents to streamline the process of liquidity provision.

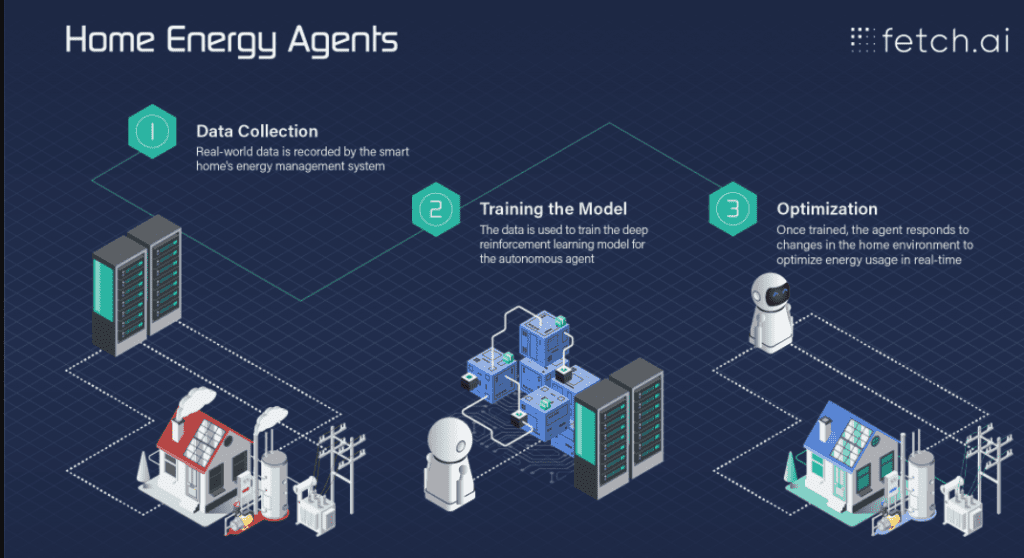

Several other use cases such as commodity exchange trading, transportation systems (delivery agents and autonomous travel agencies), and smart home systems have very scalable and viable models. These are expected to drive massive adoption that will pay off in a 3-8 year cycle.

How to Buy Fetch.ai?

Users can buy FET tokens on several cryptocurrency exchanges using fiat and crypto options. Those using market orders in a non-volatile market can expect to get the value of tokens they paid for. However, volatile market conditions require that the user use limit orders to reduce the fees they pay and avoid slippage.

FET/USDT: Weekly Chart

Follow Eno on Twitter.