- Summary:

- Fear & greed index is a crucial measure of investors' attitude towards the financial markets and the probable impact on prices.

Fear and greed are the two broad emotions that drive financial markets. They define the market sentiment, which is a crucial measure of investors’ attitude towards a financial asset. Subsequently, it lays the foundation for a viable short- and long-term forecast. The current situation, characterized by geopolitical tensions in eastern Europe and concerns over inflationary pressures, highlights how the fear & greed index impacts assets’ prices.

Fear & Greed Index latest news

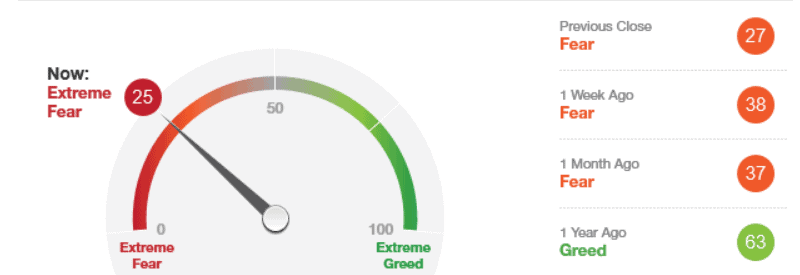

In Friday’s session, the fear & greed was at an extreme fear level of 25 compared to Thursday’s reading of 27. A figure closer to 0 indicates rising fear in the market. Conversely, a move towards 100 highlights increasing risk appetite as the level of greed rises.

As observed in the figure above, the level of risk aversion has risen in recent weeks. A year ago, it was at a greed level of 63 amid recovering economies and government stimulus. However, heightened inflationary pressures and the Fed’s plan to tighten its monetary policy has shifted the market sentiment. A month ago, the fear & greed index was at a fear level of 37. It has since intensified following the escalation of the Russia-Ukraine conflict.

The market momentum and volatility and the stock price strength and breadth are all signalling extreme fear. This explains why the stock market has recorded significant losses in recent sessions. Earlier on Friday, S&P 500 hit its lowest level since May 2021 at $4,118.60. Besides, the safe-haven demand exudes fear, which explains the rallying in safe-haven assets such as the US dollar and precious metals. For instance, on Thursday, the gold price rose to its highest level since September 2020 at $1,974.90. Similarly, the dollar index extended its gains to $97.72, its highest since July 2020.

Crypto Fear & Greed Index

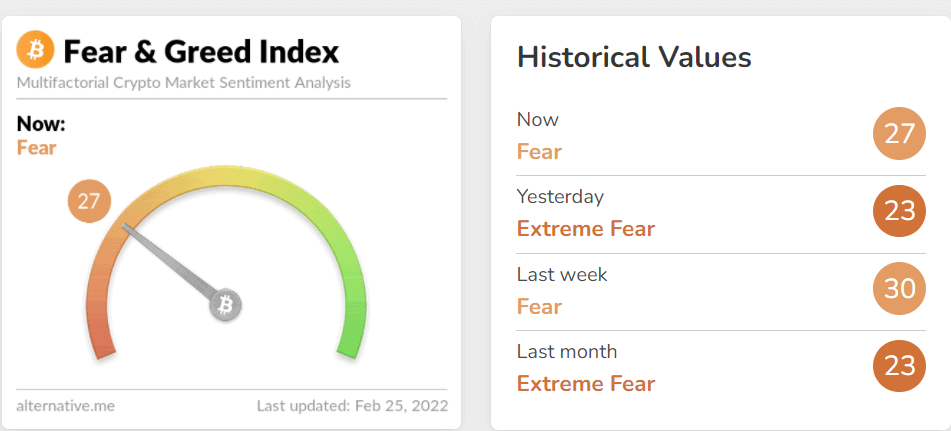

A look at the crypto market highlights a similar setup. The crypto fear & greed index, which tracks the emotion driving the cryptocurrency market, is at a fear level of 27. While it is a slight improvement from the previous session’s reading of 23, it is a sign that risk aversion is still high.

Geopolitics and talks of a tighter Fed monetary policy have had Bitcoin remain below the psychologically crucial level of $50,000 since late last year. For close to a week now, it has been facing resistance at $40,000.

Following the Russian attack on Ukraine that began on Thursday, the fear & greed index will likely remain on the fear end of the spectrum in ensuing sessions. Risk assets like cryptocurrencies, equities, and Forex will likely remain under pressure. In contrast, it will be a bullish driver for safe havens like the US dollar and gold.