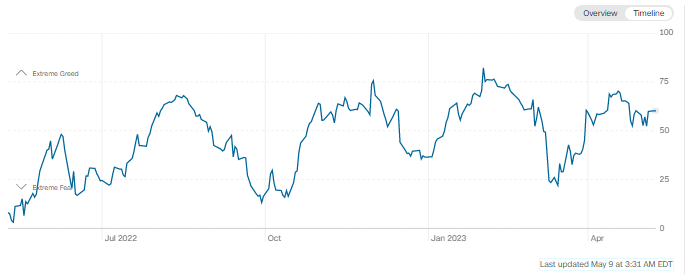

- The stock market fear and greed index has hit 60 once again which suggests that the markets are getting greedy.

The Fear and Greed Index is one of the most accurate indicators to determine market sentiment. The latest data shows that the markets have become greedy once again after remaining natural till last week. Multiple fundamental and technical indicators point toward this sentiment.

The CNN fear and greed index has hit 60, which is its highest level in the last two weeks. The index is based on seven different indicators. Currently, five different indicators are signaling greed, while two are still neutral.

NASDAQ 100 Index Hits 8-Month Highs

Due to the strong earning reports by the tech giants like Google, Facebook, Microsoft, and Amazon, tech stocks are rallying. This has led to a surge in the benchmark NASDAQ 100 index, which has hit its 8-month high. The index currently stands at 13,291, its highest level since August 2022.

The S&P 500 index has been trading sideways since last month. The collapse of First Republic Bank dropped the index to its fresh monthly lows, but it is recovering right now. The market momentum indicator of the fear and greed index depends on whether the S&P 500 is above or below its 125 MA.

If you actively trade stocks and cryptocurrencies, you’re also welcome to join my free Telegram group for my detailed outlooks on these assets.

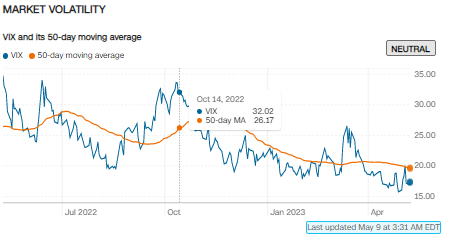

Market Volatility Remains Neutral

Out of the seven indicators of the stock market fear & greed index, the Stock Price Breadth and the Market Volatility remain neutral. Therefore, the sideways movement of the S&P 500 index comes as no surprise. The low market volatility appears to have prolonged, and a big move could be on the cards very soon.

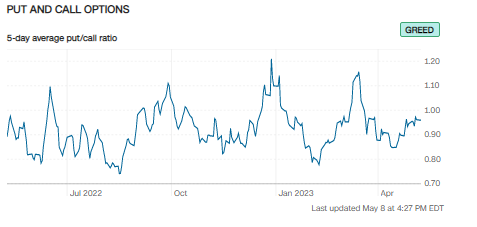

The options data is also one of the most accurate depictions of the market sentiment. The 5-day put-to-call ratio is also incorporated in the calculation of the fear and greed index. This ratio currently stands at 0.96, which shows that there are more calls in the markets right now.