- Summary:

- The Fantom price staged an incredible recovery during Wednesday's Crypto chaos and is gearing up for even more fireworks.

The Fantom price staged an incredible recovery during Wednesday’s Crypto chaos and is gearing up for even more fireworks. Fantom (FTM) was slammed to $2.522 as the altcoin market reacted lower following Bitcoin’s slide below $60k. However, the sell-off was met with aggressive buying, driving the FTM token to a new record this morning.

FTM is trading at $3.470 (+9.97%), up a staggering 187% in October, and over 20,000% year-to-date. FTM currently has a $2.25 billion market cap and is the 25th-largest crypto asset behind Stellar Lumens (XLM). The Fantom platform is making considerable headway in the Decentralized Finance (DeFi) space. According to Defillama, Fantom holds over $5.7 billion in Total Locked Assets (TVL). As a result of the network’s growth, the FTM token has recently been on a blistering run of form. When the crypto market bottomed out in July, the Fantom price was languishing at around $0.160. Fast forward three months and FTM is 2100% higher and changing hands just below $3.500, which, in my opinion, is unsustainable.

FTM Price Analysis

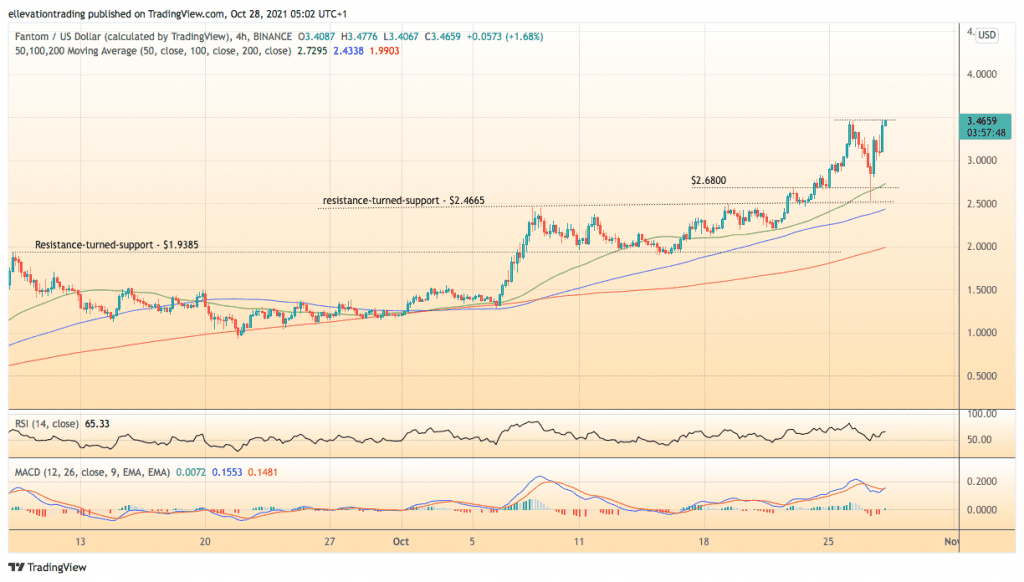

In my report published on Monday, I laid out a bullish scenario that would lift Fantom to $3.500: ‘the momentum is encouraging, and the price looks likely to extend further in the immediate future. Therefore I hold a cautiously bullish view, with a $3.5000 price target.’ However, I am even more cautious now we have reached the target price.

That isn’t to say that FTM can’t go higher because it can. The Relative Strength Index (RSI) has pulled back from overbought territory, and the MACD is pointing higher. Nonetheless, buying at the current level is hazardous. But if the Fantom price breaks through $3.500, it could encourage momentum chasers to drive it towards $4.000. However, at these heady heights, FTM is vulnerable to a sharp correction similar to Wednesday. On that basis, I am on the sidelines, awaiting a safe entry pot.

Fantom Price Chart (4-Hour)

For more market insights, follow Elliott on Twitter.