- Summary:

- Dow Jones looks set for a modest higher open this Tuesday as market hangs on to yerterday's positive news aboyut the US-China trade spat

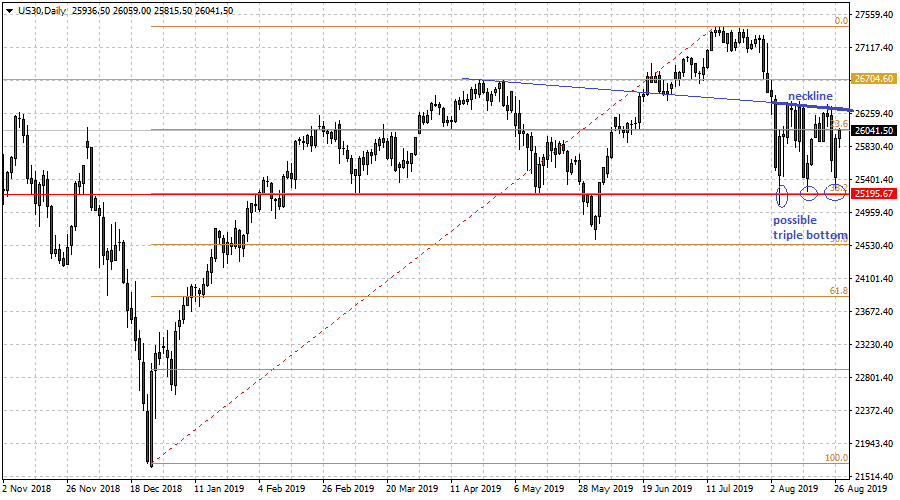

After plunging on Friday as a result of news of the new trade tariffs imposed on Chinese goods as well as the announcement of the retaliatory tariffs from the Chinese end, the US markets picked up strongly yesterday after China indicated that it was ready to negotiate trade terms with the US. The fundamentals set the tone for the price action which has resulted in a third bottom at the 38.2% Fibonacci level of the December 26 2018 swing low and July 16, 2019 swing high.

The Dow is approaching the neckline resistance area and needs to break this line to the upside to complete the triple bottom formation. The Dow presently trades at 26,054, and is testing the horizontal resistance that corresponds to the Feb 22 and March 19 highs. The price needs to break the 26,250 price barrier, which is where the price candle is expected to interact with the neckline, in order to target the 26,704 mark.

Conversely, a failed test of the horizontal support and neckline will reopen the door for a move to the 25,195 mark. Further support lies at 24, 550 and this will be targeted if the earlier support does not hold.