- Summary:

- Euro is weaker 0.06 percent today against USD after the macro data from the US; the Empire State index came in at 4.3 beating expectations

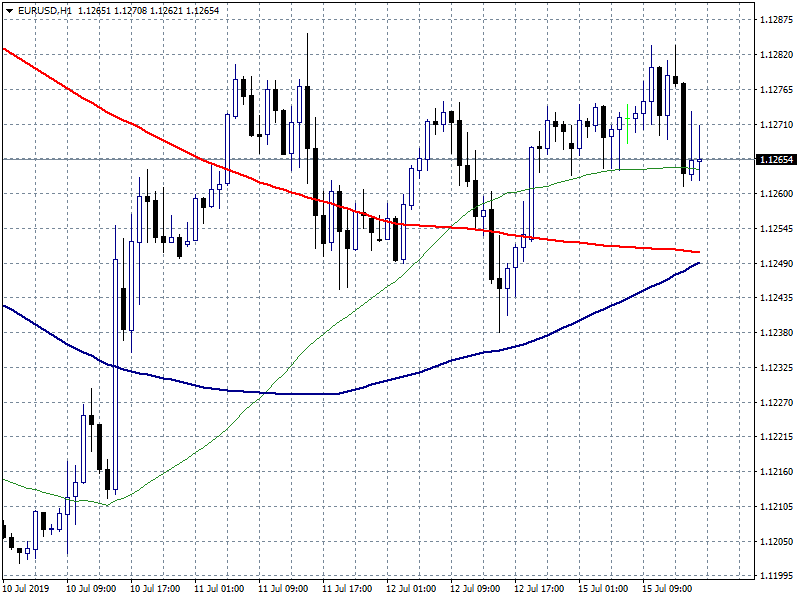

Euro is weaker 0.06 percent today against USD after the macro data from the US; the Empire State index came in at 4.3 beating expectations for July, and reversing the previous drop to -8.6. in June which was the worst since October 2016. The 6 month business conditions also improved +30.8 versus +25.7 in June. Investors are increasing bets for another round of monetary stimulus from ECB in the near term, with interest rate cuts and the restart of the QE programme.

On the technical side, the short term momentum is neutral. On the downside the pair will find support at 1.1238 the low from Friday while more bids will probably emerge at 1.1201 the low from July 10th. Immediate resistance for the pair stands at 1.1283 today’s high and then at the psychological 1.13 round figure, a break above can lead prices up to 1.1325 the 200 day moving average before an attempt to yearly high.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.