- EURUSD add 0.10 percent at 1.1095 after US July non-farm payrolls came in at +164K slightly missing expectations of +165K. US Trade Balance came in at

EURUSD add 0.10 percent at 1.1095 after US July non-farm payrolls came in at +164K slightly missing expectations of +165K. US Trade Balance came in at -55.2B below forecasts of $-54.6B in June. In European macro news earlier the EU June retail sales came in at +1.1% beating expectations of +0.3% m/m, while the EU June PPI came in at -0.6% worse that expectations of -0.3% m/m.

European Central Bank is preparing new monetary stimulus, probably an interest rate cut in September and the re-start of the QE programme. The deterioration of the EU and especially German economic outlook limiting any occasional positive reaction in EURUSD.

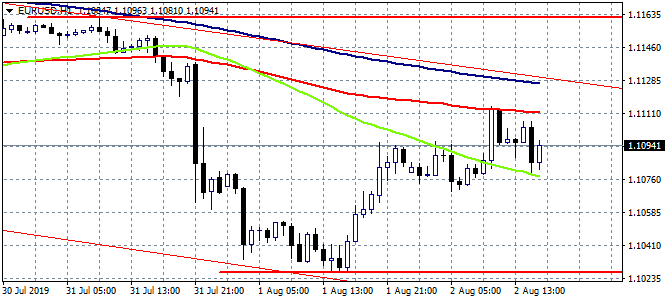

EURUSD broke below 1.11 mark after Fed’s decision to cut interest rates by 25 bp and bears now are in control for the midterm amid general USD strength, targeting the 1.10 zone. The pair has trapped in the downward channel from mid July and needs a break above 1.11 to regain positive momentum. In the hourly chart EURUSD looks trapped now between the 50 and 100 hour moving averages. A short position targeting the 1.10 mark with a stop loss order at 1.11 is something that day traders can try if the pair breaks below 1.1077 the 50 hour moving average targeting the lows at 1.1026. A long position might be initiated if the pair manages to climb above 1.11 targeting 1.1114 the daily high. A narrow stop loss to 1.1085 must also be placed for reducing the downside risk. In the case EURUSD breaks below 1.1026 the downward move will accelerate down to 1.10 and then at 1.0950. The RSI in daily chart is at 35 and probably avoids at least for the oversold levels.Don’t miss a beat! Follow us on Twitter.