- Summary:

- Euro is weaker today against USD as the macro data from Germany continue to disappoint investors. German factory orders shrunk to 2.2 percent

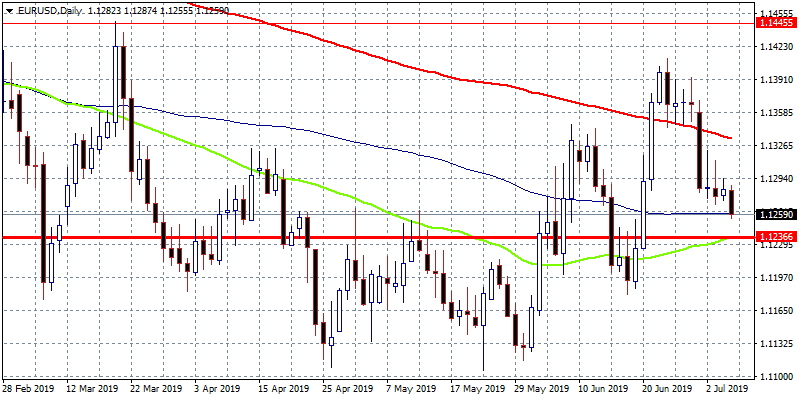

Euro is weaker today against USD as the macro data from Germany continue to disappoint investors. German factory orders shrunk to 2.2 percent m/m for May, much worse than analysts’ expectations of -0.1 percent just to reaffirm the dismal economic environment in Germany and in the EU also. The figure for April was at +0.3 percent. The France May trade balance came in at -€3.28 billion better than analysts’ forecast of -€4.85 billion.

On the technical side, the short term momentum is neutral. On the downside the pair will find support at 1.1260 the 100 day moving average while more bids will probably emerge at 1.1229 the 50 day moving average. Immediate resistance for the pair stands at 1.13 psychological figure, a break above can lead prices up to 1.1340 the 200 day moving average before an attempt to yearly high. I am still positive for the pair as long as it trades above 1.1260, a break below that level will attract sellers.Don’t miss a beat! Follow us on Twitter.