- Summary:

- Euro after a quiet session trading in just 10 pips trading range managed to break higher at 1.1240 amid geopolitical tensions, after USA accuses Iran

Euro after a quiet session trading in just 10 pips trading range managed to break higher at 1.1240 amid geopolitical tensions, after USA accuses Iran for the two attacks in oil tankers at the Gulf of Oman. Traders are awaiting the FED policy meeting while global markets closely monitoring the escalation in US-China trade war. The July futures suggest a 66.6% chance of a cut as inflation slows and the global economy weakens. I believe that the longer the trade war goes on, and tariffs are in place against China, the more likely is that the Fed will cut rates. Interest rates in EU are expected to remain at current levels at least through H1 2020. Trade war concerns have re-emerged after President Trump refused to shed further details on a potential implementation of tariffs on extra $325 billion of Chinese imports. Earlier the United States NAHB Housing Market Index registered at 64, below markets expectations (67) in June.

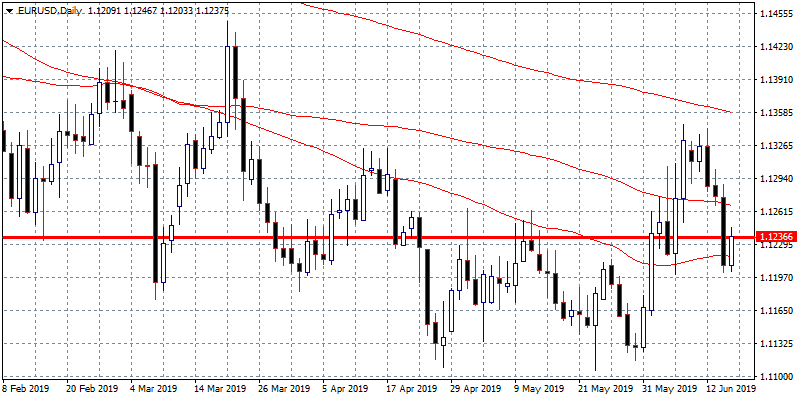

On the technical side, bulls are building the short term momentum which collapsed the previous week as the pair breached the 200 hour moving average. Currently the pair hit the resistance at 1.1245 the 50 hour moving average. A break above can lead prices up to 1.1277 and the 100 hour moving average. On the downside the pair will find support at 1.1218 the 50 day moving average while more bids will emerge at 1.12 round figure. Investors should be cautious at current level and ahead of the FOMC meeting next Wednesday.