Euro is giving up 0.07 percent to 1.1359 as traders digest the comments from FED members yesterday that calm the markets after the interest rate cut hysteria that started the previous week. Fed’s chairman Jerome Powell reiterated FOMC view that the case for lower rates has gain momentum but noted that the interest rate policy should not overreact. Earlier today the pair hit the daily low 1.1352 and the daily high at 1.1371. Macro data from USA failed to impress USD investors as The New Home Sales Change (Month on Month) came in -7.8% lower at 0.626M below economist’s forecasts of 1.9% and 0.68M for May. The United States Richmond Fed Manufacturing Index came in at 3 below analyst’s forecasts of 5 for June. The consumer confidence weakened in June with the headlines Confidence Index dropping to 121.5 in June from 131.3 in May.

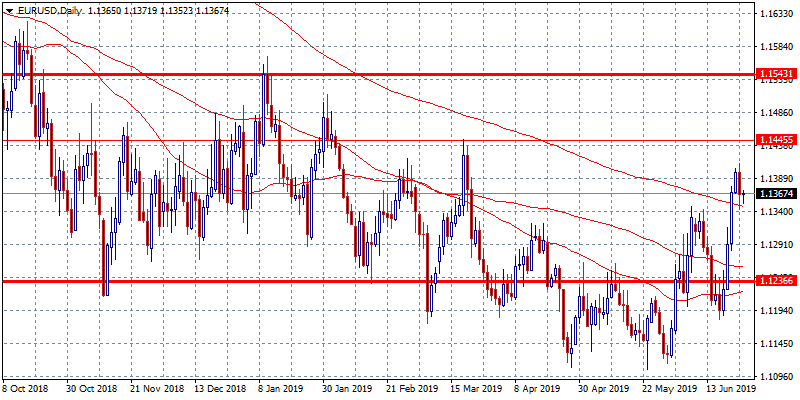

On the technical side, bulls are holding the bullish momentum that has build on dovish FED. The pair yesterday lost the 1.14 mark during Jerome Powell speech and stopped at the 200 day moving average. Immediate resistance stands at 1.14, a break above can lead prices up to 1.1411 the high from yesterday before an attempt to yearly high. On the downside the pair will find support at 1.1344 the 200 day moving average while more bids will emerge at 1.13 round figure. Traders closely watching the 1.1344 mark as a break below might cancel the recent positive scenario.