- Summary:

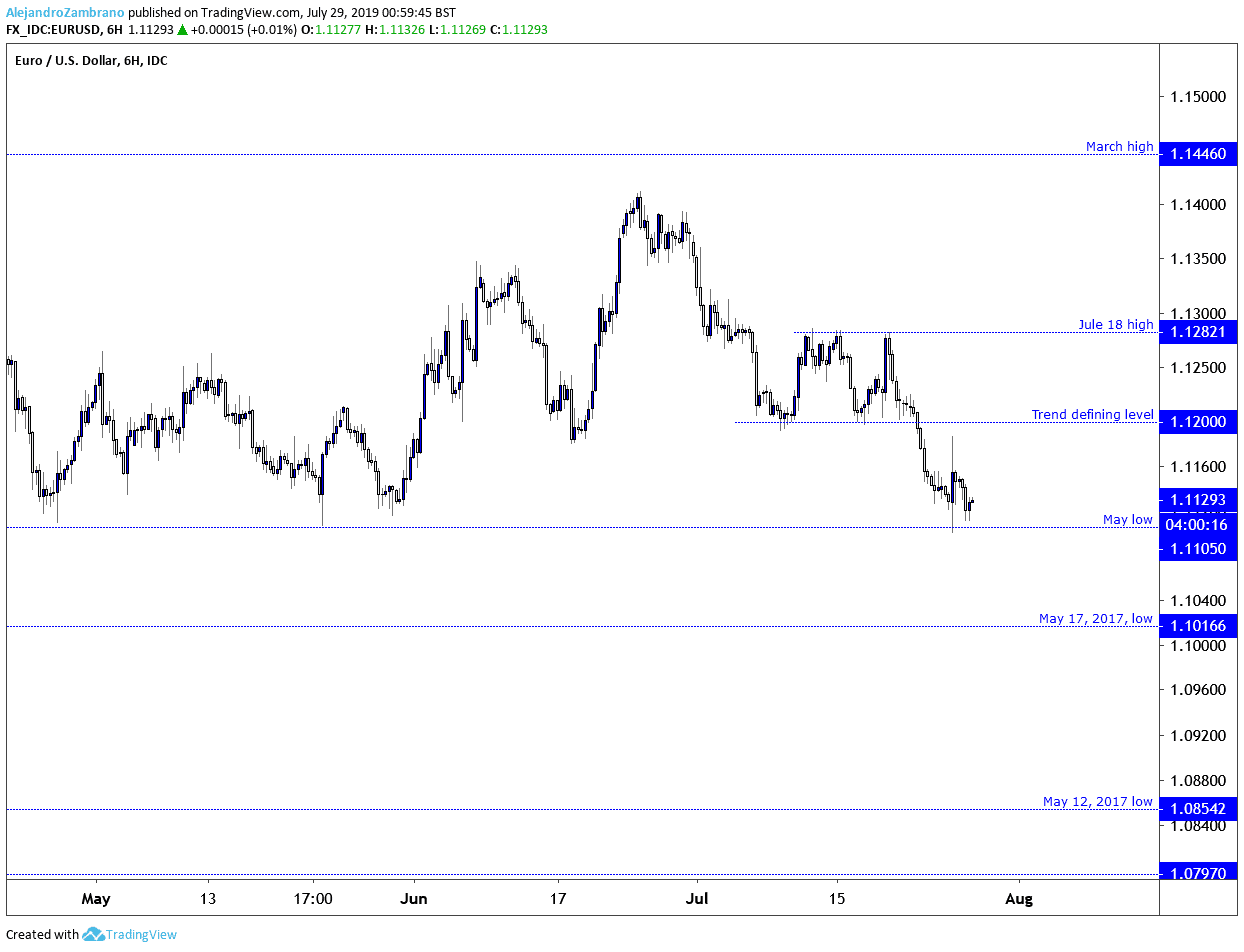

- A break to the May low of 1.1105 might send the EURUSD to the psychological level of 1.1050, followed by the May 17, 2017, high of 1.1016.

As projected last week, EURUSD turned lower from the 1.1184 level and revisited its May low. Today, I suspect that bearish traders will be wary with entering new positions as the price is resting just above the May low of 1.1105 providing a low risk-reward ratio to new positions. If the May low holds the price might reach the 1.1150 level and we might see some traders try to short-sell between 1.1150 and 1.12. However, my preference is to wait for a break to the May low as it might send the EURUSD to the psychological level of 1.1050, followed by the May 17, 2017, high of 1.1016. A daily close to the May low could also suggest that the pair have started to trend from being choppy since June 2018. Unfortunately, the macroeconomic backdrop is not very encouraging as both the ECB and Federal Reserve are ready to reduce their key rates and will therefore not provide a good bias for fundamental traders. The question going forward is which central bank will be the most aggressive with their rate cuts, but it will probably make more sense to pair the Euro or USD with a currency of a country with a central bank that is not looking to reduce rates.Don’t miss a beat! Follow us on Twitter.