- EURUSD volatility has risen noticeably and today the price created a new weekly high and a new weekly low. Adding to the volatility was soft US PMI figures.

EURUSD volatility has risen noticeably in today’s session as the price earlier today created a new weekly high, followed by a fresh weekly low four hours later. At the time of writing the price was rising again, following very soft US Markit PMI figures. In particular, the service sector index was weak as it fell to 50.9 from 53 in July, and below the 52.8 projected by economists. The manufacturing PMI dropped below the vital 50-threshold and is now indicating a contraction in the US manufacturing sector. The decline in the manufacturing index took the index to a 119-month low according to Markit, the report producer.

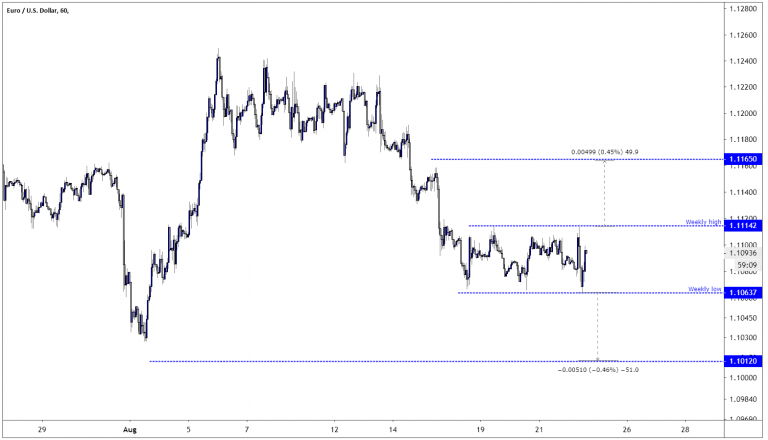

As the markets have been quiet for the whole week, and we are in the summer holiday period for at least three weeks more, we should not hope too much from the EURUSD, but today’s news is bearish. The weak composite number, which is a combination of the services and manufacturing index, suggests that the US economy is growing by 1.5% annualized.From a technical point of view, the EURUSD pair is trapped within a rectangle pattern of 1.1063 and 1.1114. The difference between the lower and higher limit of the rectangle is 51 pips, and a break to the weekly high at 1.1114 might sent the price to 1.1165, while a slide to the weekly low might send the exchange rate to 1.1012 per the classic interpretations of the rectangle pattern.