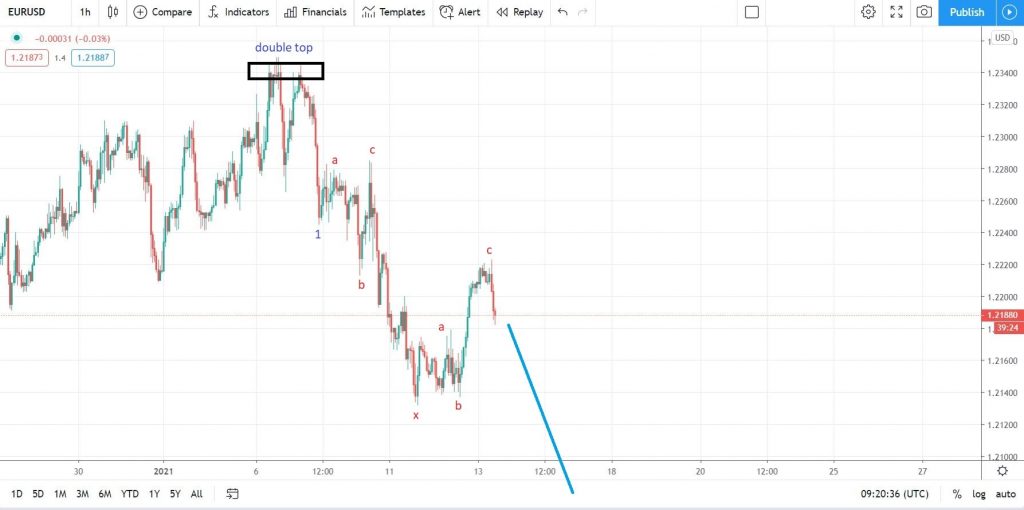

- EURUSD Elliott Waves analysis suggests another leg lower might be in cards after the pair formed a double top above 1.23.

The EURUSD pair seems to have turned a corner. After the double top formation above 1.23, it traded close to 1.21 yesterday, only the regain 1.22 late in the North American trading sessions. From an Elliott Wave‘s point o view, the pair seems to form a running correction, part of a complex second wave.

Europe has a hard time. The second wave of the pandemic hit the core states harder than the first one. If we add to it the cold weather (e.g., Spain has the coldest weather in the last two decades) and the fact that Germany extended the lockdown until April, there are little or no reasons to cheer.

There are no important economic data out of Europe this week, so the focus remains on what is happening in the United States. Today’s CPI may be a market mover, but the market’s attention will likely stay on the transfer of power that currently takes place in the United States.

EURUSD Elliott Wave Count

The Elliott Wave count from the double top suggests an impulsive wave with a running correction for the second structure. If that is the case, the EURUSD should decline further and make a new low towards 1.2050 area before consolidating in a contracting triangle. Therefore, bears may want to short at market with a stop loss at 1.2260 and a take profit at 1.2050.

EURUSD Price Forecast