- Summary:

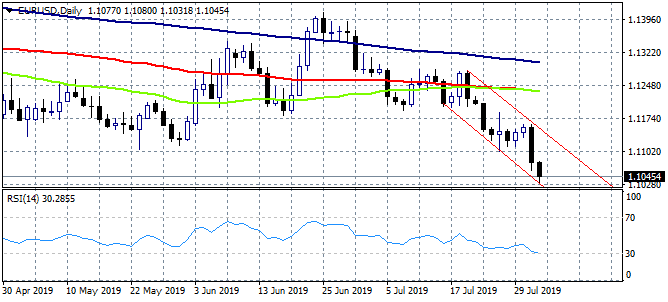

- EURUSD gives up 0.26 percent at 1.1045 just 14 pips above the daily and two year lows after the FOMC cut interest rates by 25 basis points as widely

EURUSD gives up 0.26 percent at 1.1045 just 14 pips above the daily and two year lows after the FOMC cut interest rates by 25 basis points as widely expected by markets. European PMI’s disappointed for one more time; Germany Markit Manufacturing PMI came in at 43.2, below expectations of 45.4 in July, France Markit Manufacturing PMI came in at 49.7 also below forecasts of 50 in July. Italy Markit Manufacturing PMI came in at 48.5, topping expectations of 48 in July. Spain Markit Manufacturing PMI came in at 48.2, also above expectations of 48 in July. The EU Markit Manufacturing PMI came in at 46.5, above forecasts of 46.4 in July.

European Central Bank is preparing new monetary stimulus, probably an interest rate cut in September and the re-start of the QE programme. The deterioration of the EU and especially German economic outlook limiting any occasional positive reaction in EURUSD.

EURUSD broke below 1.11 mark yesterday after the Fed’s decision and bears now are in control for the medium term amid general USD strength, targeting the at 1.10 zone. The pair has trapped in the downward channel from mid July and needs a break above 1.11 to gain positive momentum. A short position targeting the 1.10 mark with a stop loss order at 1.1051 is something that day traders can try. A long position might be initiated if the pair manages to climb above 1.1080 the daily high targeting 1.1121 the 50 hour moving average. A narrow stop loss to 1.1050 must also be placed for reducing the downside risk. In the case EURUSD breaks below 1.1033 the downward move will accelerate down to 1.10. The RSI in daily chart is at 30 and is entering oversold levels, so a rebound can’t be ruled out.Don’t miss a beat! Follow us on Twitter.