- Summary:

- The Euro made a push higher in the European session to recover some of last week's losses. EURUSD now in a channel formation.

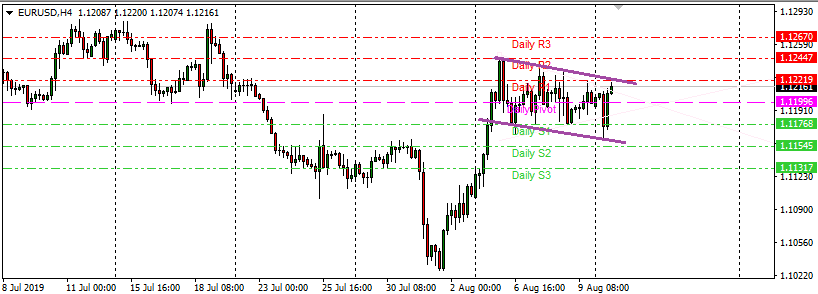

The EURUSD was able to gain 45 pips in the European trading session. This has pushed the Fibre to the top end of a consolidation range which can be defined within the context of a channel pattern. This range extends between the 1.1244 resistance (R2 pivot) and the 1.1160 support (close to S2 pivot).

The 4-hour chart indicates the channel pattern and the key intraday pivots that bulls and bears need to break through to achieve their price objectives.

The EURUSD bears would need to see price action retrace from the present levels at the upper end of the channel, back to the channel lower border and possibly lower. A break below the 1.1160 key support by a double candle close or a 3% penetration close, would take the EURUSD below the channel pattern, which would open the door for a test of 1.1131 and possibly 1.1108 (July 26 low).

The bulls would look at the pattern formation as a possible bull flag in evolution, in which case they would be looking for a clear break of the upper channel border, beyond the 1.1244 resistance. Such an upside break would have to be accompanied by rising volumes, and would target the 1.1267, 1.1292 and 1.1313, in that order.