- Summary:

- EURUSD gives up 0.04 percent at 1.1120 at the daily low as traders await the FOMC decision later this week. Markets have already discounted a 25 basis

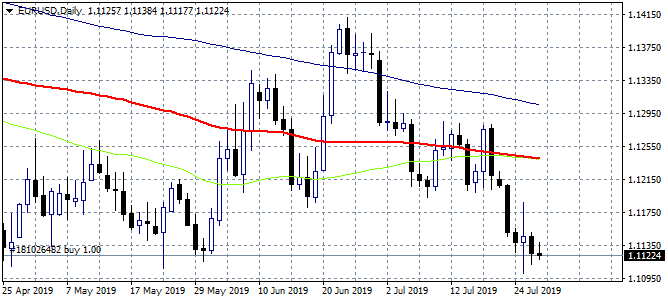

EURUSD gives up 0.04 percent at 1.1120 at the daily low as traders await the FOMC decision later this week. Markets have already discounted a 25 basis points rate cut from Fed. Spain HICP (year over year) came in at 0.7%, below expectations of 0.8% in July, the Consumer Price Index (year over year) met forecasts of 0.5% in July.

The pair broke below 1.12 the previous week and bears now are in control for the short term amid general USD strength, targeting the yearly low at 1.1101. Traders have to avoid now long positions as ECB will ease monetary policy in September and the political drama in Italy resurfaces.

A short position targeting the 1.11 mark with a stop loss order at 1.1130 is something that day traders can try. A long position might be initiated if the pair manages to climb above 1.1136 the 50 hour moving average targeting 1.1187 the high from July 25th. A narrow stop loss to 1.11 must also be placed for reducing the downside risk. A break below 1.11 will accelerate the downward move down to 1.1050.Don’t miss a beat! Follow us on Twitter.