- Summary:

- The EURUSD continues to slide on the day after Pfizer informs the EU that there will be shipment delays for its coronavirus vaccines.

The EURUSD continued its slide on Wednesday as demand for the safe-haven US Dollar picked up in Friday’s New York trading session.

Further pressurizing the single currency is the report that indicates the EU may not get the full stock of the Pfizer/BioNTech COVID-19 vaccine it ordered as a result of shipment delays. According to the company, shipments will be updated by March.

With regards to the European angle of the pandemic, Germany and Italy are considering tighter lockdown measures, with the latter also considering setting a March date to ease the lockdown. The EUR/USD is trading at 1.20922 as of the time of writing.

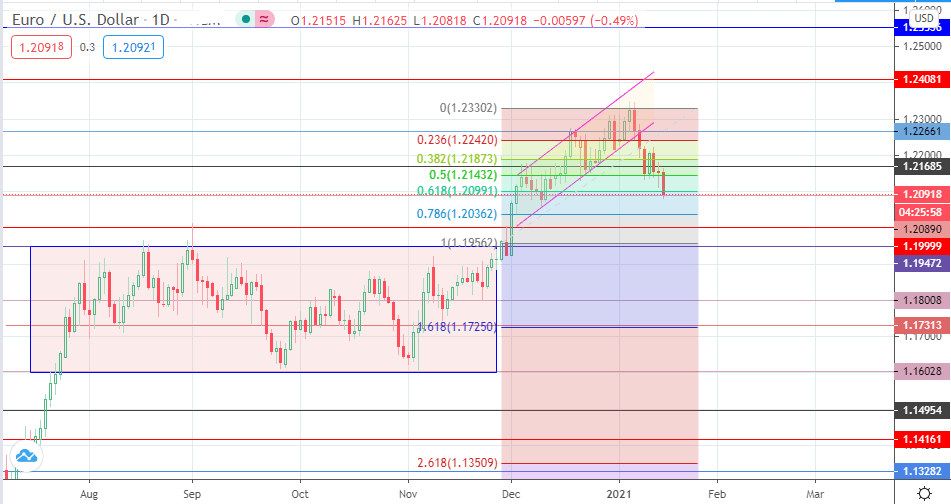

Technical Outlook for EURUSD

The price is now testing support at 1.2089. A breakdown of this area brings in 1.19999 into the picture. 1.19472 and 1.18008 round off short-term targets to the south that could become relevant if the EURUSD keeps declining.

On the other hand, a bounce on 1.2890, which is the 61.8% Fibonacci retracement from the 30 November to 7 January price swing, allows recovery of the uptrend, targeting 1.21685 and possibly 1.22661 in the short term. 1.24081 remains an upside target last seen in April 2018.

EURUSD Daily Chart