Euro retreats below 1.13 after the recent rally at 2 month high as NFP the previous week came in worst than expected and disappointed investors. The U.S. Bureau of Labor Statistics reported that nonfarm payrolls in the U.S. rose by 75,000 in May to miss the analysts’ estimate of 185,000 by a wide margin. The CME Group FedWatch showed that the probability of a rate hike in July rose to 75%. Interest rates in EU are expected to remain at current levels at least through H1 2020. In the old continent, Bank of Italy recently announced that it expects the real GDP to expand by 0.3% in 2019 driven by consumer spending and exports. Reuters reported that the EU saw the disciplinary procedure over Italy’s debt was warranted.

Euro speculative positions, increased by over 12,000 contracts this week according to COT report. Bets improved for a second straight week and for the third time in the past four weeks. The overall position is now under the -100,000 net contract level for a second week and perhaps signaling that the extreme negative sentiment by speculators is waning.

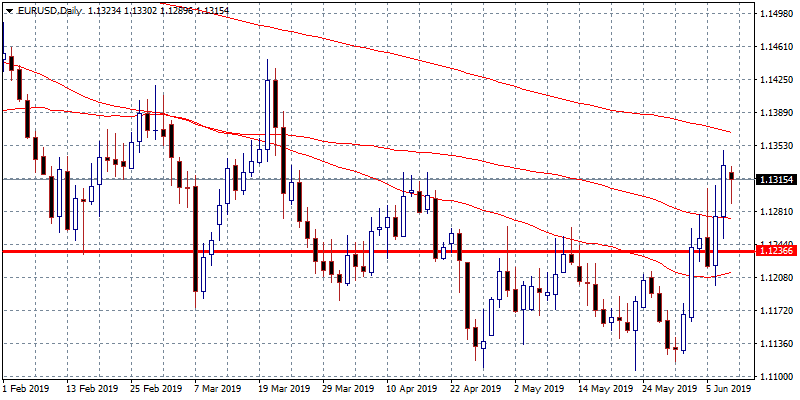

On the technical side, the bullish momentum sketched the previous week is under scrutiny today as the pair started weak below the 1.13 mark. Immediate support for the pair stands at the 100 day moving average at 1.1273 while more bids will emerge at 1.1216 the 50 day moving average. On the upside immediate resistance is at the 200 day moving average at 1.1367, a break above can drive prices up to 1.14.