- Summary:

- EURUSD gives up 0.08 percent at 1.1136 in just 12 pips trading range as traders await the FOMC two-day policy meeting, at which it is expected to cut

EURUSD gives up 0.08 percent at 1.1136 in just 12 pips trading range as traders await the FOMC two-day policy meeting, at which it is expected to cut interest rates by 25 basis points. Markets have already discounted a 25 basis points rate cut from Fed. Germany Gfk Consumer Confidence Survey came in line with analysts’ expectations of 9.7 in August. The France Gross Domestic Product (QoQ) came in at 0.2%, below expectations of 0.3% in 2Q. France Consumer Spending (MoM) came in at -0.1% below forecasts (0.2%) in June.

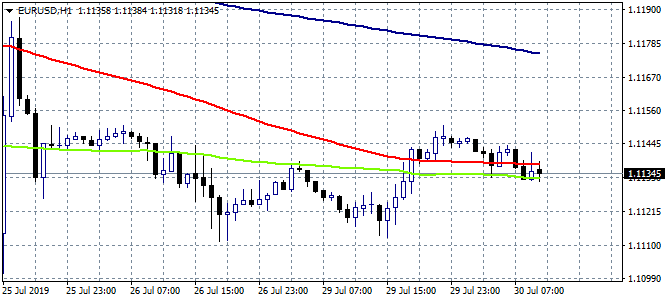

EURUSD broke below 1.12 mark the previous week and bears now are in control for the short term amid general USD strength, targeting the yearly low at 1.1101. The pair looks trapped between the 50 and 100 hour moving averages as defined by the green and red line respectively in our chart. A short position targeting the 1.11 mark with a stop loss order at 1.1141 is something that day traders can try. A long position might be initiated if the pair manages to climb above 1.11376 the 100 hour moving average targeting 1.1187 the high from July 25th. A narrow stop loss to 1.11 must also be placed for reducing the downside risk. In the case EURUSD breaks below 1.11 the downward move will accelerate down to 1.1050. I don’t expect any major move before the FOMC decision tomorrow; investors can wait for the decision and then start a trading position following the trend.Don’t miss a beat! Follow us on Twitter.