- Summary:

- Euro consolidates today to two day low after yesterday broke the 1.13 and the 200 hour moving average at 1.1285 as geopolitical tensions increase

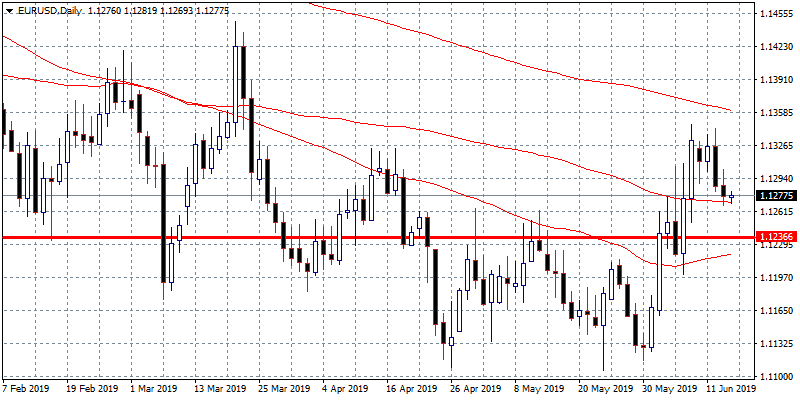

Euro consolidates today to two day low after yesterday broke the 1.13 and the 200 hour moving average at 1.1285 as geopolitical tensions increase after USA accuses Iran for the two attacks in oil tankers at the Gulf of Oman. Fed funds futures are currently pricing in three rate cuts for 2019. I believe that the longer the trade war goes on, and tariffs are in place against China, the more likely is that the Fed will cut rates. Interest rates in EU are expected to remain at current levels at least through H1 2020. Trade war concerns have re-emerged after President Trump refused to shed further details on a potential implementation of tariffs on extra $325 billion of Chinese imports. Today we are waiting the Retail Sales for May and the advanced June U-Mich index and Industrial/Manufacturing Production., both events will affect the EURUSD price.

On the technical side, the bullish momentum sketched the previous week collapsed as the pair breached in Asian session the 200 hour moving average and now the pair will test the key 100 day moving average at 1.1270 which if broken might accelerate the slide further towards 1.1219 the 50 day moving average. On the upside first resistance stands at 1.13 and a convincing break above will target 1.1347 monthly high. Investors should be cautious at current level and ahead of the FOMC meeting next week.