Euro is giving up 0.08 percent to 1.1357 after the GDP revision for the first quarter expanded by 3.1% in a YoY basis to match previous estimate and the economist’s estimates. The Personal Consumption Expenditures Prices reported at 0.5% on a quarterly basis for first quarter better than analysts’ forecast. The initial Jobless Claims came in at 227,000 beating analyst’s estimates of 220,000 for June 21. Traders digest the recent comments from FED members that calm the markets after the interest rate cut hysteria that started the previous week. Fed’s chairman Jerome Powell reiterated FOMC view that the case for lower rates has gain momentum but noted that the interest rate policy should not overreact.

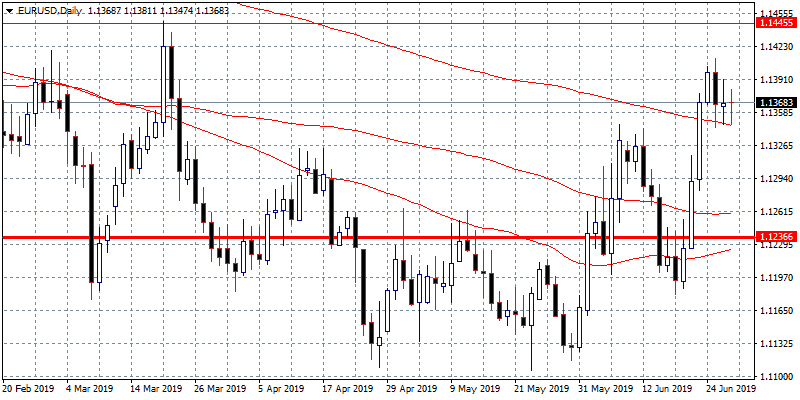

On the technical side, bulls are holding the bullish momentum that has build on dovish FED. The pair rejected at 1.14 mark earlier this week. Immediate resistance for the pair stands at 1.14, a break above can lead prices up to 1.1411 the high from yesterday before an attempt to yearly high. On the downside the pair will find support at 1.1344 the 200 day moving average while more bids will emerge at 1.13 round figure. Traders closely watching the 1.1344 mark as a break below might cancel the recent positive scenario.