- Summary:

- EURUSD is trading 0.18% higher at 1.1105 getting a hand from better PMI data in Eurozone. Germany’s Manufacturing PMI came in at 43.6 beating expectations

EURUSD is trading 0.18% higher at 1.1105 getting a hand from better PMI data in Eurozone. Germany’s Manufacturing PMI came in at 43.6 beating expectations of 43 in August the Composite PMI also came in at 51.4 above forecasts of 50.5 in August. The EU Manufacturing PMI came in at 47 topping forecasts of 46.2 in August.

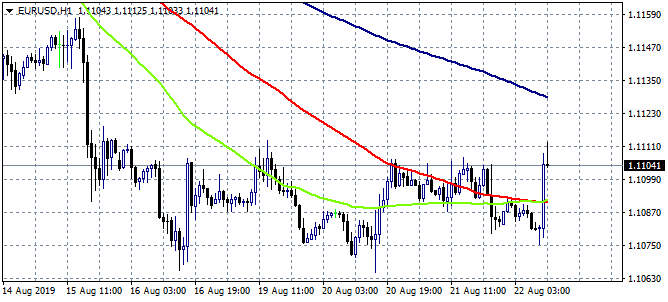

EURUSD is trading above and below the 1.11 mark as traders are indecisive about the next move of the common currency. Bears are still in control as the pair trades below all the major daily moving averages, but in the hourly chart the bulls are gaining momentum as the pair pierced the 50 and 100 hour moving averages. On the upside immediate resistance stands at 1.1112 today’s high and then at 1.1129 the 200 Hour moving average, a break above can lead prices up to 1.12 mark. The pair will meet support at 1.1075 the daily low and then at 1.1066 the low from August 16nd, before an attempt to 1.1026 yearly low.

Intraday traders might enter a long position if the pair manages to break above the 1.1112 top targeting a break above 1.1150. A stop loss at 1.11 must also be placed for reducing the downside risk as that will signal possibly a move down to 1.1050 area.

A short position targeting the YTD low may be initiated if the pair crosses below 1.1066, with a stop loss order at 1.11. All in all bears are in control and if EURUSD breaks below 1.1166 the downward move might accelerate down to 1.1026 yearly low and then at 1.0950.