- Summary:

- The EURUSD is little changed as trader wait for the critical Non-Farm payrolls. Read our update to find out what levels matters for traders.

The EURUSD is little changed this morning, as traders are on the sidelines ahead of the critical Non-Farm payrolls at 13:30 London time. The very short-term trend in the pair remains upwards as the EURUSD has been boosted by a series of disappointing reports from the US this week. On Tuesday, the ISM manufacturing report dipped to levels not seen in ten years, while Thursday saw the ISM services dip to 52.6 from 56.4, and below the 52.6 projected. The weak US data caused traders to challenge the strong dollar and resulted in a natural price correction.

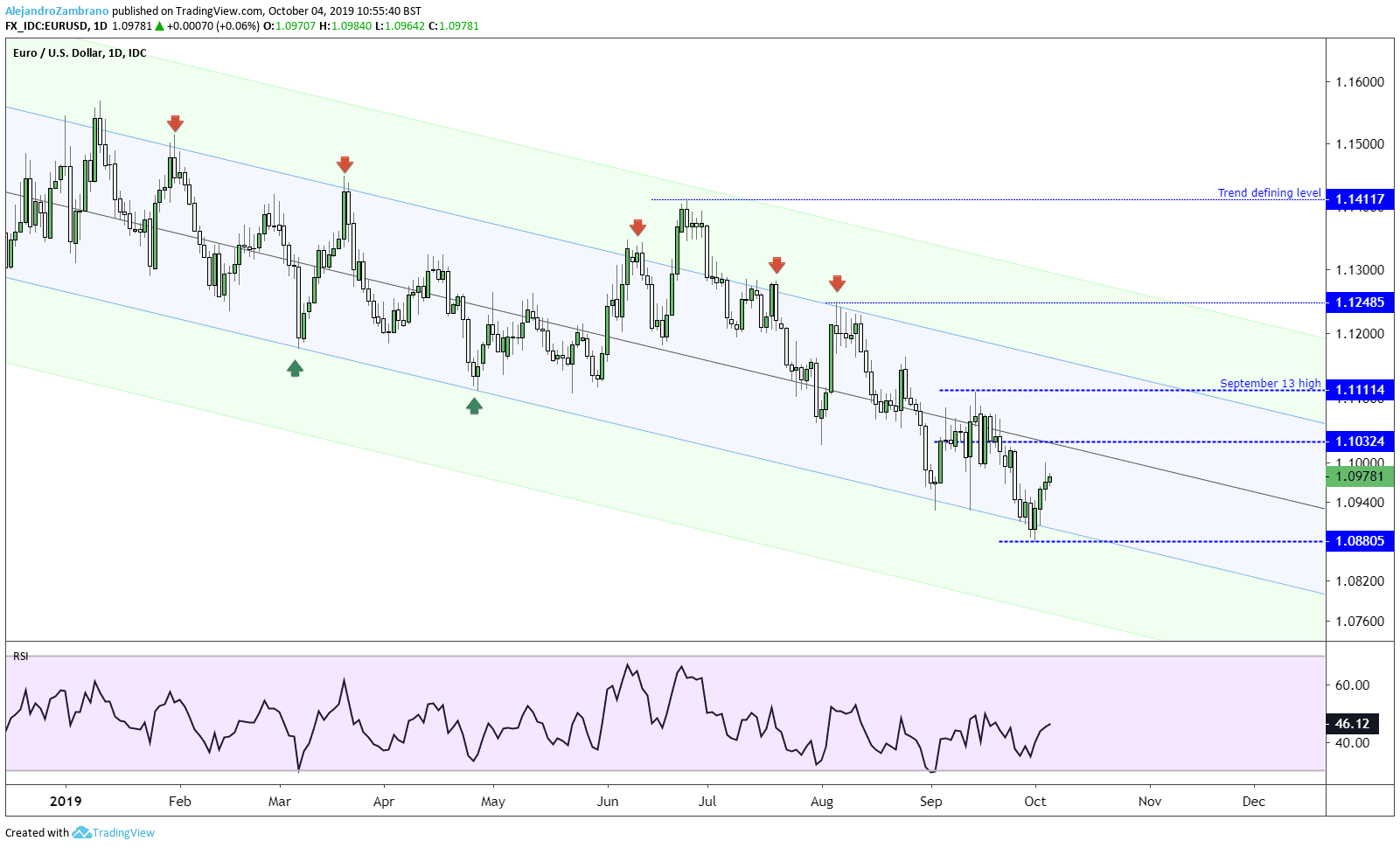

The short-term price trend of EURUSD remains upwards and will stay upwards as long as the price trades below yesterday’s low of 1.0938. Technically, the price is trying to reach the September 24 high of 1.1023, followed by the inverse head and shoulders pattern target of 1.1051.

If the Nonfarm Payrolls job creation meets expectations of 145,000 new jobs, the EURUSD might continue to add to its gains. A markedly lower reading than expected, such as a reading of 100,000 or below, can further boost the EURUSD. However, if the price prints decisively higher, like a print around 160,000 and above then it might send the EURUSD lower. The reason for having a lower threshold of a positive beat is that while the economist’s expected outcome is 145,000 jobs, traders’ expectations seem to be lower and around 100,000 according to financial twitter. A break to the October 3 low will end the short-term uptrend.

Download our EURUSD Q4 Outlook Today!

[vc_single_image image=”14654″ img_size=”medium” alignment=”center” style=”vc_box_rounded” onclick=”custom_link” img_link_target=”_blank” link=”https://news.investingcube.com/q4-global-market-outlook-eurusd-gold-crude-oil-bitcoin-sp-500/”]Looking beyond the short-term price action for the EURUSD, the trend remains firmly bearish. Drawing an “Andrew’s pitchfork” using the August and September 2018 minimum and max levels, suggest that sellers might emerge around the median line, currently at 1.1032 and the September 13 high of 1.1114. If the price indeed turns lower here, the next support level in the EURUSD will be the 2019 low of 1.0880. However, if the price manges to trade above 1.1114 then the EURUSD would be poised to add to its gains.