- Summary:

- Traders will be closely watching news from the ECB today and the comments from Chairman Mario Draghi during the press conference for clues about

Traders will be closely watching news from the ECB today and the comments from Chairman Mario Draghi during the press conference for clues about the central bank next move.

The Eurozone economy expanded by 0.4% on quarter in the three months to March of 2019, matching the previous readout and the expectations, the third estimate showed. On an annualized basis, the Eurozone GDP figure arrived at 1.2%, confirming the previous 1.2% reading while matching the expectations of 1.2%.

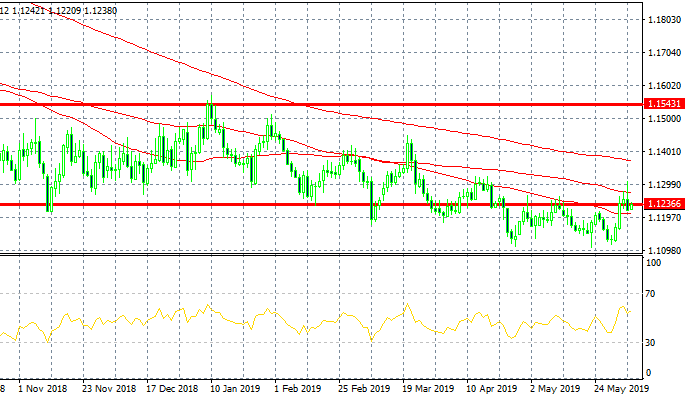

On the technical side, in a volatile session, the more dovish hints from the Fed and a weak ADP employment report temporarily sent euro prices above the previous day’s high as well as below the prior day’s low, forming a bearish Outside Bar. The pair rejected at the 1.13 level and retreated back to 1.1230 area which is the lower band of the channel that spend most part of the year (between 1.1236 and 1.15). The pair has also trapped between the 50 and 100 day moving averages and only a strong catalyst which might be today Mario Draghi can break the range decisively. The pair will meet strong support around 1.12 zone which if breached can open the way for a second test down to 1.11 yearly low. On the upside more resistance stands at the 100 day moving average at 1.1276 while more sellers will emerge at the 1.13 area.