- Summary:

- The EURJPY pair declined to a seven-week low as traders reacted to the weak EU inflation data and because of the Bank of Japan decision

The EURJPY pair dropped to an intraday low of 123.28, which is the lowest it has been since July 30th. The pair is reacting to the Bank of Japan interest rate decision, the new Suga administration, and the weak inflation data from Europe. Similarly, the USDJPY and GBPJPY pair are also in the red.

The EURJPY is in its fourth straight day in the red as the focus turns to Yoshihide Suga, the new Japan prime minister. The premier pledged to continue with Shinzo Abe’s policies, which include a close realignment with the United States. He will also continue to court China, the country’s biggest trading partner. Also, he has pledged to provide more government support to the economy.

The EUR to JPY pair is also reacting to the Bank of Japan interest rate decision. The bank left interest rate unchanged at -0.10% as most analysts were expecting. It also upgraded the economic forecast for the economy.

Meanwhile, in Europe, economic data by Eurostat disappointing. The data showed that the headline consumer price index declined by 0.4% in August. That led to an annualised decline of 0.2%. The core consumer price index fell by 0.6% but rose by an annualised rate of 0.4%. These numbers imply that the ECB will likely leave rates unchanged for a longer period than the Fed.

EURJPY technical outlook

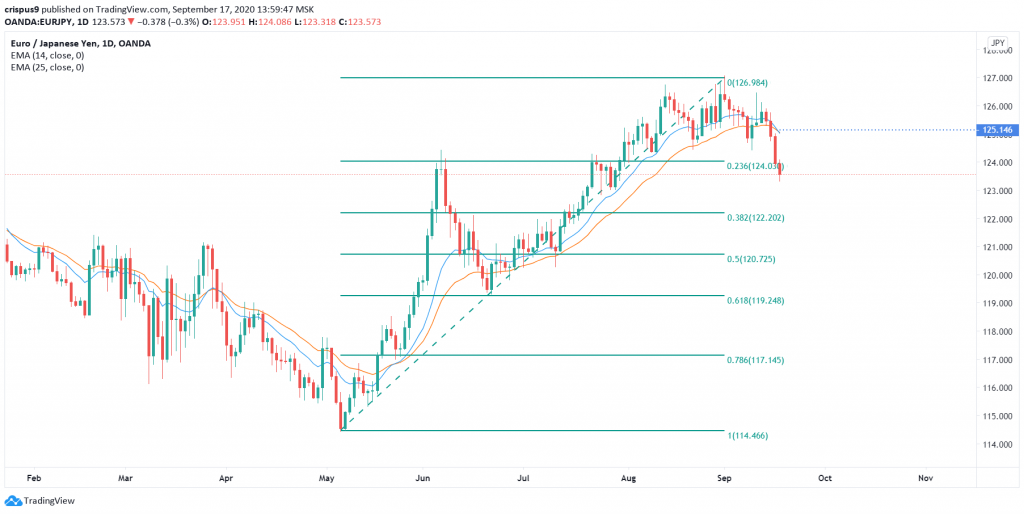

The EURJPY pair is trading at 123.28. On the daily chart, the price has just moved below the 23.6% Fibonacci retracement level of 124.00. The price has also managed to form a three dark crows pattern, which is usually a confirmation of a downward trend. Most importantly, the 25-day and 14-day exponential moving averages have made a bearish crossover.

That means that the pair is likely to continue falling as bears aim for the 38.22% retracement at 122.20. On the flip side, a move above 125.00 will invalidate this trend. This price is at the intersection of the 25-day and 14-day moving averages.

EUR to JPY technical chart