- Summary:

- On the technical analysis side the bulls are fighting to stay in control of EURGBP as the pair trades above all major daily moving averages and as of

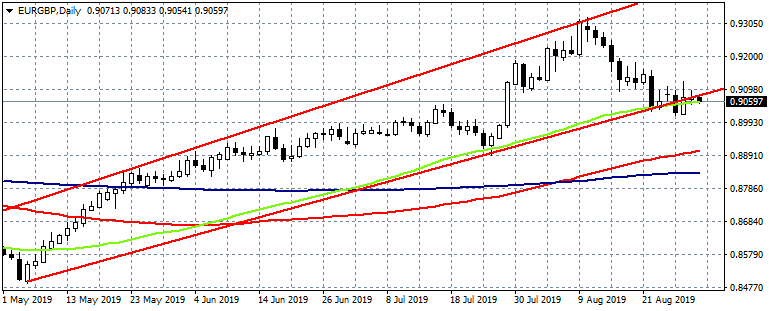

EURGBP gives up 0.08% at 0.9068 testing the 50-day moving average support at 0.9060 making an attempt to enter inside the ascending channel from May 2019. On the data front, Germany Retail Sales (month over month) came in at -2.2% below expectations of -1% in July, the yearly reading increased to 4.4% in July from previous -1.6%. In France Producer Prices (month over month) came up to 0.4% in July from previous -0.5%; the Consumer Price Index (month over month) came in at 0.5% topping expectations of 0.4% in August. European Monetary Union Consumer Price Index (year over year) came in at 1% meeting forecasts for August. Italy Consumer Price Index, year over year, increased to 0.5% in August from previous 0.4%. UK government looking to extend the Parliament recess period to 14 October, which means the parliament can’t block a no-deal Brexit.

On the technical analysis side the bulls are fighting to stay in control of EURGBP as the pair trades above all major daily moving averages and as of writing the pair trying hold above the 50 day moving average; EURGBP registered a huge rally since May bottoming out around 0.8500 and hitting the high of 0.9323 in August 12th. On the upside, immediate resistance stands at 0.9092 yesterday’s high, while more offers will emerge at the 0.9161 the high August 21st. On the downside, first support stands at 0.9054 today’s low, while the next barrier is at 0.8978 the low from July 29th. Investors holding long positions can sit comfortably as long as the pair trades above 0.90. For those looking to sell the pair a break below 0.90 could be the trigger for a correction down to 0.8950 zone.

EURGBP Testing the 50 Day Moving Average

EURGBP Testing the 50 Day Moving Average