- Summary:

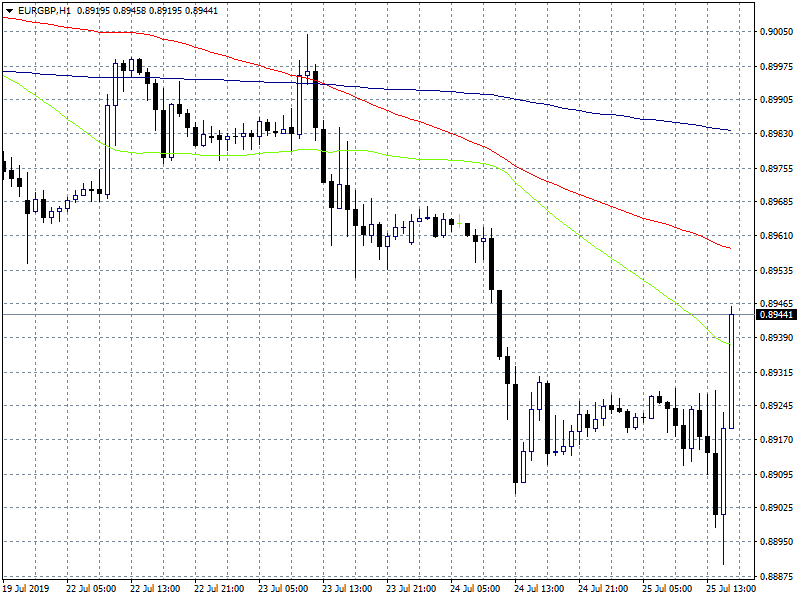

- EURGBP was under strong selling pressure after the ECB announced that keeps interest rates unchanged. The pair hit the daily low at 0.8890

EURGBP was under strong selling pressure after the ECB announced that keeps interest rates unchanged. The pair hit the daily low at 0.8890 but as Mario Draghi started his press conference and said that the policy commitee didn’t discuss today the possibility of an interest rate cut the pair rebounded and as of writing hits the daily high at 0.8943.

Here are the key points from Mr Draghi’s presentation:

Inflation pressures muted

We have tasked Eurosystem Committees to examine options

Data point to somewhat weaker growth in Q3 and Q4

Weakness primarily due to softer global growth, and hurting Eurozone manufacturing

Significant monetary stimulus is needed

On the technical side the short term momentum turns neutral for the pair as it trades below the 100 and 200 hourly moving averages. On the upside immediate resistance stands at 0.8958 the 100 hour moving average will more offers will emerge at 0.8983 the 200 hour moving average. On the downside first support stands at 0.8890 today low while next barrier is at 0.8792 the 200 day moving average.

The pair has been on a huge run higher since May after bottoming out around 0.8500 in a move to hit a high of 0.9051 last week.Don’t miss a beat! Follow us on Twitter.