- Summary:

- The British pound has softened vs. the Euro and could be in the process to try to trade lower after the likelihood of no-deal Brexit has intensified.

The British pound has softened vs. the Euro and could be in the process to try to trade lower after gaining since August 12. The trigger behind the latest slide in the British Pound is the news that the UK parliament might be suspended from next week when Parliament is supposed to end its summer recess. The idea is that it will stop MPs from blocking a no-deal Brexit which is supposed to go ahead on October 31 given the current legislation. The market is therefore set on that we might indeed have a no-deal Brexit, and the British Pound has declined.

However, that analysis does not take into account that it might force Ireland and the EU to give up on their backstop requirement. The EU will now have about one week to come back to the UK if they want to avoid a no-deal Brexit, so there is still a chance that the British Pound might be able to stage a rebound. Right now, anything is possible.

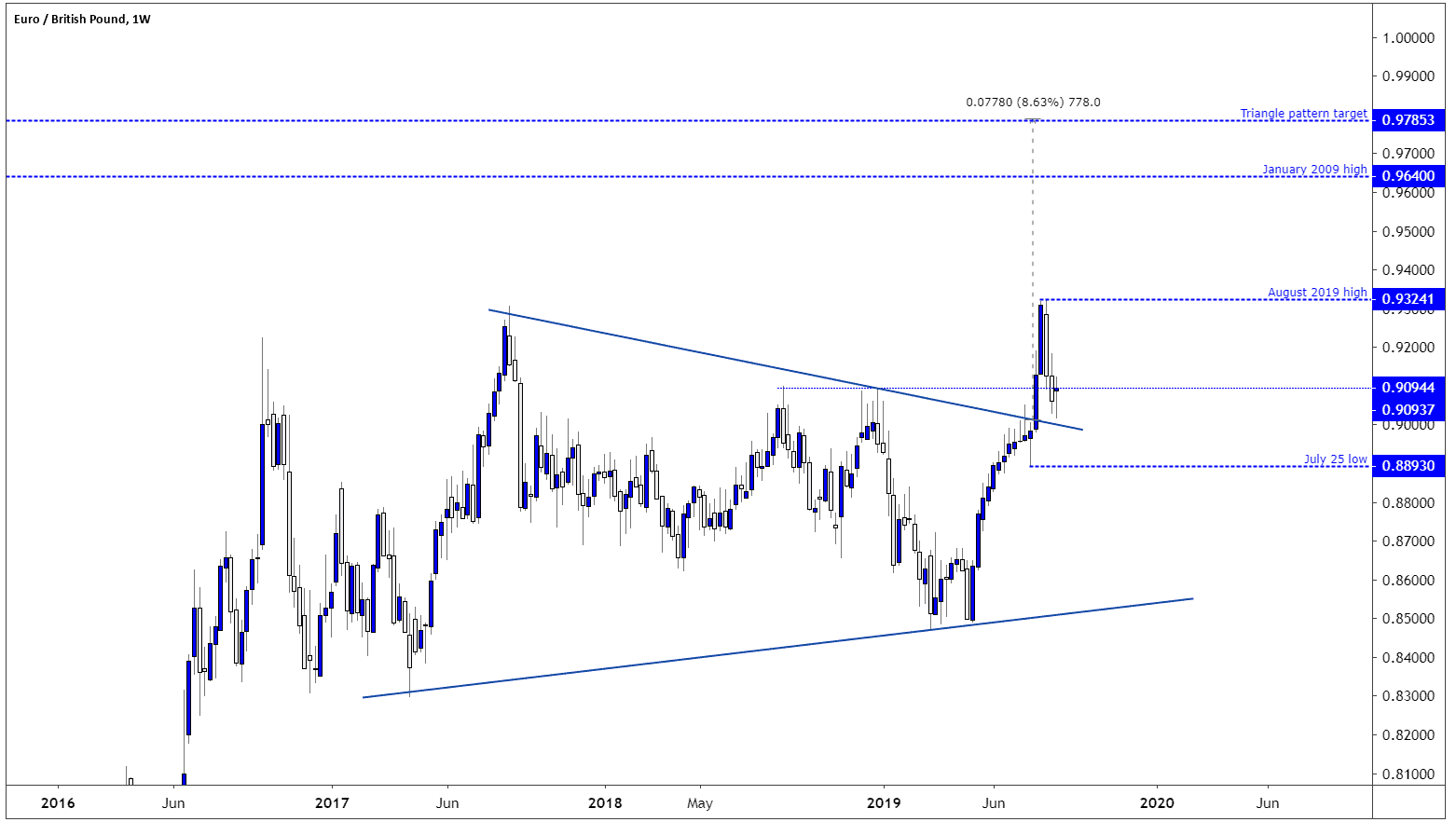

Technically, the EURGBP pair is bullish above the July 25 low of 0.8891, and as long as the price trades above the July 25 low there is a chance that the price will revisit the August 12 high of 0.9324. Also, between 2017 and mid-2019 the price formed a significant triangle pattern. However, in the final week of July the price traded beyond the triangle borders and triggered a buy signal. The patter is now suggesting that the EURGBP pair might trade as high as 0.9785, which would be a new ten-year high.

For the pattern to fail, the price would need to trade below the July 25 low, something that might happen if the EU decides to throw in the towel.