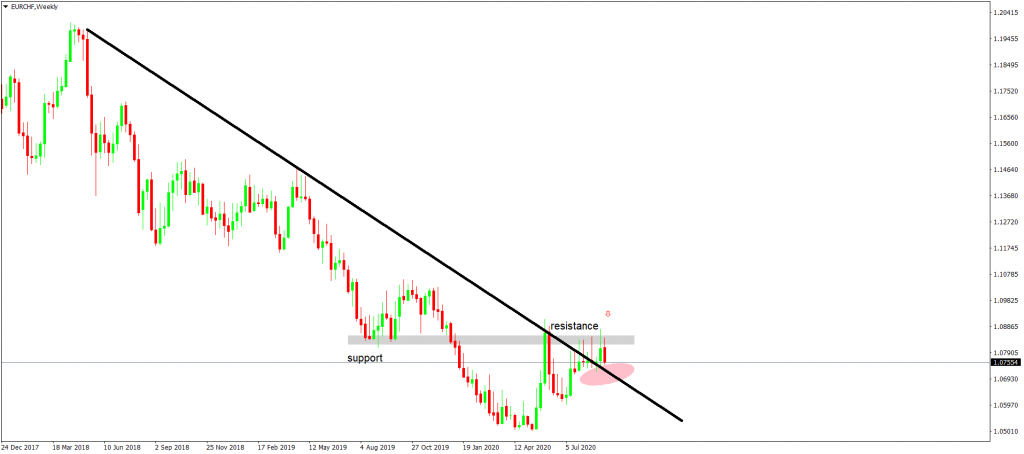

- EURCHF remains bearish despite breaking an important bearish trendline. As long as the series of lower highs remains in place, the cross is bearish.

The EURCHF is a currency pair that failed to show the Euro bulls’ enthusiasm during the coronavirus pandemic. While it broke an important trendline on the weekly timeframe, it did not do the same with the series of lower highs, maintaining a bearish bias.

Moreover, on its recent move higher, it failed twice previous support turned into resistance. It looks like a double top is in place, and more weakness is in the cards.

Game-Changer ECB Press Conference

Today’s ECB press conference may be a game-changer for the Euro for the months left until the U.S. Presidential election. While the ECB is unlikely to deliver another rate cut at this point (it already has the deposit facility rate below zero for several years now), traders will focus on the press conference and the message there.

The ECB cannot remain indifferent when inflation threatens to turn into deflation. As such, a dovish bias for today’s press conference exist, especially given the strength seen on the EURUSD exchange rate.

SNB Failed to Weaken the CHF

Despite its efforts, the SNB fails to keep the CHF from appreciating. Its balance sheet continues to rise, and its portfolio now has a big exposure on international assets like the technology sector in the United States.

The SNB is a central bank like no other and owns participations in foreign assets. The idea is to sell the CHF when paying for those participations in the local currencies. This way, the SNB diversifies its portfolio while actively participating in the CHF movement.

EURCHF Technical Analysis

The chart below reveals the difficulties the EURCHF has on any move higher. It bounced from the lows only to meet the falling trendline, and now it got rejected for the second time from the previous support turned resistance.

Bears would want to short it at the market with a stop loss at the recent high and target 1.06 for a nice risk-reward ratio.

EURCHF Price Forecast