- Summary:

- The EUR/USD price is in a consolidation phase as investors shift from last week's ECB decision to the upcoming statement by the Fed

The EUR/USD price is in a consolidation phase as investors shift from last week’s ECB decision to the upcoming statement by the Federal Reserve. The pair is trading at 1.0210, where it has been in the past few days. The EUR to USD exchange rate is still above this month’s low of 0.9956.

Fed, US GDP, and consumer confidence

The EUR/USD price moved in a sideways direction as investors waited for a relatively busy week. The Conference Board will publish the closely watched consumer confidence data on Tuesday. With inflation soaring, analysts expect the country’s confidence to drop sharply this month. Consumer confidence is important data because consumer spending is the most important part of the American economy.

The next key event will be the interest rate decision by the Federal Reserve that will happen on Wednesday. Analysts believe the bank will hike interest rates by either 0.75% or a full 1%. I expect it to hike by 0.75% even after the country’s inflation surged to the highest level in more than four decades. The decision will come a week after the ECB delivered its first interest rate hike in 11 years.

Finally, the EUR/USD price will react to the upcoming US GDP data and PCE that are scheduled for Thursday. These numbers are expected to show that the economy slowed down in Q2 as inflation rose and as China locked some of its key cities.

EUR/USD forecast

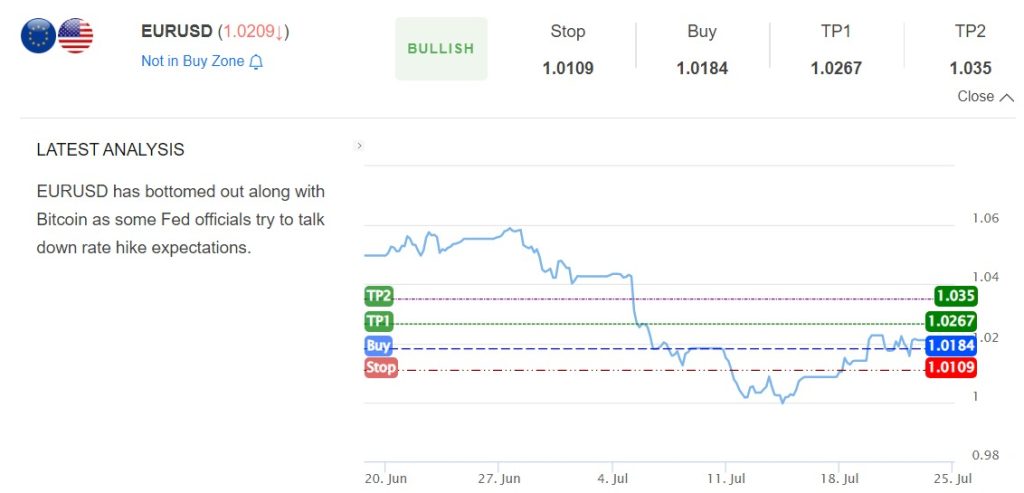

The two-hour chart shows that the EUR to USD exchange rate has been moving sideways in the past few days. As a result, the pair is consolidating along the 25-period and 50-period moving averages. The Relative Strength Index (RSI) is at the neutral level of 50.

Therefore, the pair will likely continue consolidating as traders position themselves for the upcoming events. A move above last week’s high of 1.0271 will signal that there are more buyers in the market while a drop below 1.013 will open the possibility of it moving to parity again.

EUR to USD support and resistance levels

According to the highly accurate InvestingCube S&R indicator, the EURUSD price has a bullish outlook, with the two main targets being at 1.0267 and 1.035.