- Summary:

- The EUR/USD price declined slightly as investors waited for important economic data from the United States and Europe.

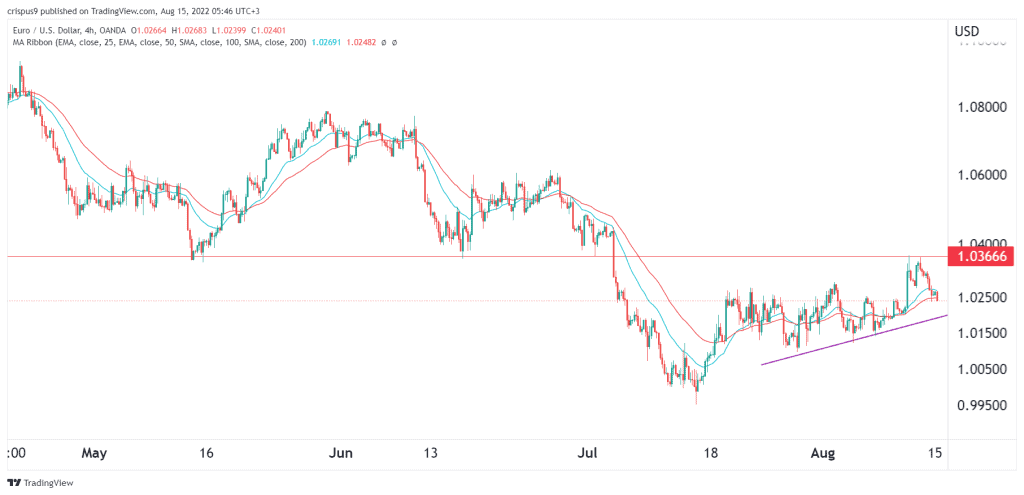

The EUR/USD price declined slightly as investors waited for important economic data from the United States and Europe. It retreated to a low of 1.0250, which was lower than last week’s high of 1.0366. The price is about 2.91% above the lowest level this year.

US retail sales data and FOMC minutes

The EUR/USD price pulled back ahead of important data. On Wednesday, the US will publish the latest retail sales numbers. Economists expect the data to show that the country’s retail sales remained under pressure in July this year as inflation remained at an elevated level.

Retail sales are an important part of the economy since consumer spending is the biggest part of the economy. Notably, these numbers will come on the same week that the biggest US retailers like Target, Home Depot, and Lowe’s are expected to publish their results.

The EUR/USD price will also react to the FOMC minutes that will come out on Wednesday. These minutes will provide more clarity about what the Fed will do in the coming months. The bank decided to hike interest rates by 0,75% in the past meeting.

There will be other important data that will have an impact on the EUR to USD exchange rate. For example, the EU will publish the latest GDP and inflation numbers. In addition, the US will also publish the important housing starts, building permits, and manufacturing production data.

EUR/USD forecast

The EUR/USD price has been in a strong bullish trend in the past few weeks. It managed to move from a low of 0.9957 in July to 1.0366 this month. It has moved above the ascending trendline shown in purple and is along the 25-day and 50-day moving averages. On the other hand, the Relative Strength Index (RSI) has pulled back slightly.

Still, according to the highly accurate InvestingCube’s S&R indicator, the pair remains on a bullish trend. The next key level to watch will be last week’s high of 1.0366. A drop below the support at 1.0186 will invalidate the bullish view.