- Summary:

- The EUR/GBP pair has spiked 1% this Friday after hawkish comments from an ECB policymaker and record PPI data.

The EUR/GBP has spiked higher this Friday, trading at 11-day highs as hawkish bets for an interest rate adjustment by the European Central Bank hit the markets.

Speculations of an interest rate increase by the ECB pitted against the recent dovish comments of the Bank of England are fuelling the uptick in the EUR/GBP pair. The BoE had toned down on its recent hawkish stance in last month’s meeting. But sky-high inflation levels in the UK may prompt further increases in interest rates by the Bank of England, even as a BoE policymaker opined that rates needed to be upped “a little bit” further.

However, the focus for market participants is on the Euro, whose underperformance against the US Dollar and the British Pound was caused by a lag in vaccination coverage, control of the spread of the COVID-19 variants and economic recovery.

ECB Governing Council member Martins Kazaks indicated in a Bloomberg interview that a rate hike could happen as early as July. However, he also said that the bank did not need to wait for more robust wage growth before taking action. Recent German producer price index data also beat expectations by a wide margin and set a historical record, highlighting a potential for higher consumer prices.

The EUR/GBP is trading 1% higher as of writing.

Technical Outlook for EUR/GBP

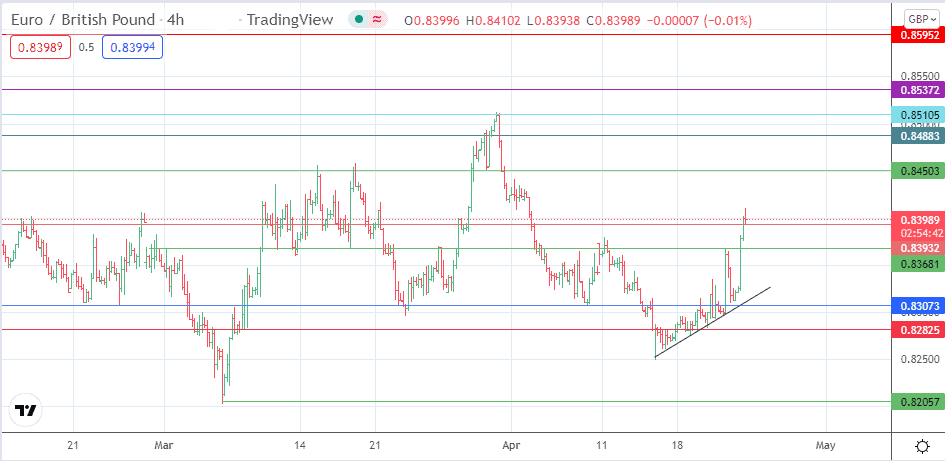

The intraday violation of the 0.83932 resistance needs to translate into a breakout to provide the pair with clear skies to target the 0.84503 resistance. Additional barriers to the north are seen at 0.84883 and 0.85105 (31 March 2022 high).

On the flip side, the bears would be aiming to initiate a corrective pullback that targets 0.83681 initially before attempting a breakdown of the 0.83073 support. This support is strengthened by an ascending trendline that connects recent lows. The bears must take out this support level for the 0.82825 (8 March and 19 April lows) pivot to come into the mix. The 14 April low at 0.82500 forms an additional southbound target.

EUR/GBP: Daily Chart

Follow Eno on Twitter.