- Summary:

- The recent negative outlook on the Euro by Rabobank has soured sentiment on several Euro pairs, including the EUR/CHF.

Rabobank’s negative outlook for the EUR/USD pair also seems to have soured sentiment on other Euro pairs. The EUR/CHF is down 0.55%, wiping off the gains of the last three trading sessions after Rabobank said it foresaw the Euro going below parity against the greenback in 1-3 months if the fundamentals continue working against the single currency.

The EUR/CHF has been on the path of a persistent decline, losing its own parity status with the Swiss Franc after the drop of 29 June sent the pair tumbling to 0.9968. Since then, the pair has dipped even more and presently struggles to hold the 0.9750 price mark.

This trajectory has put the EUR/CHF dangerously close to attaining the low of January 2015, when the collapse of the 1.2000 minimum peg set by the Swiss National Bank sent the Swiss Franc soaring. A technical look at the daily chart shows the price action trading in a tight range following the recent drop. Here’s the outlook for the EUR/CHF.

EUR/CHF Forecast

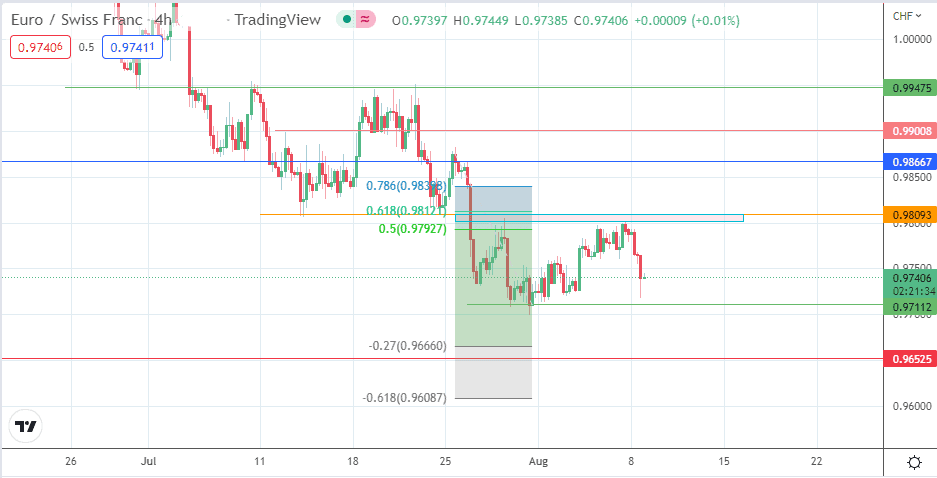

There was a rejection of the upside retracement at the resistance zone found between 0.98006 and the 61.8% Fibonacci retracement from the swing high of 25 July to the swing low of 29 July at 0.98121. This rejection aided the downward move that targets 0.97112 (28 July 2022 low).

The initial bounce off this price level has come off the intraday candle high of the 2 August 1700 hrs candle. The bears need to force the price action to test the 0.97112 support. A breakdown of this support level brings the 0.96525 price mark into the picture as the next downside target.

On the other hand, a break of the supply zone at the 61.8% Fibonacci retracement level is needed to invalidate the previous outlook, bringing 0.98667 into the mix as the initial upside target. If the bulls uncap the barrier at this 8 July low/16 July high, 0.99475 becomes the new target for the bulls. However, the psychological barrier at 0.99000 (12 July high) stands as the barrier which must be overcome for the 6 July/21 July peak at 0.99475 to be attained.

EUR/CHF 4-Hour Chart