- Summary:

- The EUR/CHF pair is trading higher this Tuesday after German Preliminary CPI data came in higher than expected.

The EUR/CHF has extended the bullish moves of 26 August and 29 August with a 0.69% push to the north this Tuesday. This uptick follows the release of the German Consumer Price Index data showing that annualized consumer price inflation stood at 7.9% for August 2022. This was higher than the market expectation, which predicted a one-percentage-point drop.

The monthly CPI and the Harmonized Index of Consumer Prices or HICP (monthly and annualized) figures all remained unchanged, indicating that the previous rate hike by the European Central Bank (ECB) has not made any dent in the rise in consumer prices. These data are the preliminary data, with the final results to be published on 13 September.

With energy prices 25% higher in August 2022 than they were a year earlier, the data leaves a narrow window open for the European Central Bank to potentially hike rates when it meets next week to decide on the monetary policy direction of the Eurozone.

The Federal Statistics Office in Switzerland will also release its Consumer Price Index data for August 2022, with inflation expected to have risen 0.2% on a monthly basis after the previous month showed no change in consumer prices.

With expectations of a rate hike by the ECB, the EUR/CHF posted a solid performance on Tuesday, enabling the pair to recovery from the month’s earlier losses. The EUR/CHF is up 0.24% for the month after posting heavy declines in June and July 2022.

EUR/CHF Forecast

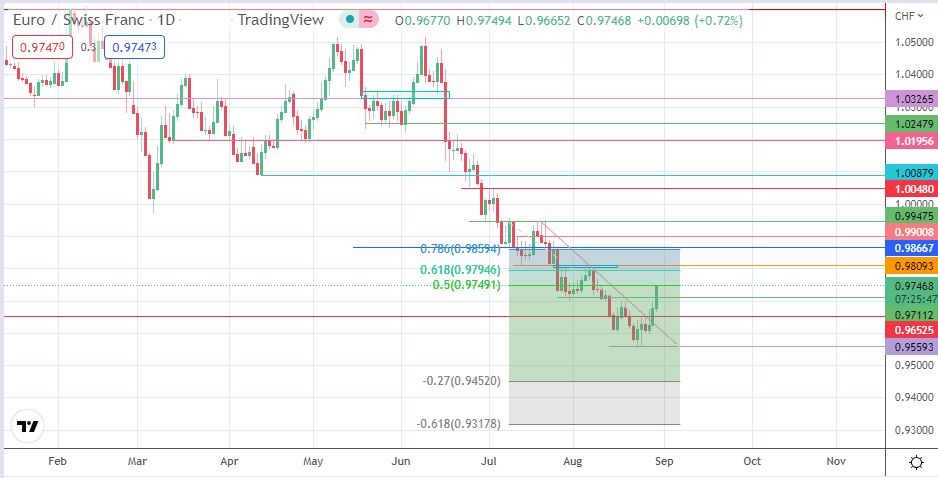

The intraday surge confirms the break of the descending trendline by the 29 August candle and the 0.96525 resistance (12 August low/25 August high). The violation of the 0.97112 resistance (28 July low) needs breakout confirmation from a 3% penetration close above this level with a 3% penetration.

This would give the bulls clear skies to push the retracement toward the 0.98093 resistance, where the 13 July low and 28 July high are found. A clearance of this barrier makes the 0.98667 resistance level available, with 0.99008 (12 July high) and 0.99475 (21 July high) forming additional targets to the north.

However, rejection of price action at the current high (50% Fibonacci retracement from the 8 July swing high to the 23 August swing low) or the 61.8% Fibonacci retracement level could cause a resumption of the downtrend. This situation would see 0.97112 and 0.96525 become vulnerable support targets.

0.95527 is the 23 August all-time low on the pair that needs to stay intact. Otherwise, the potential for a drop into record-low territory heightens. This would make the 27% Fibonacci extension at 0.94520 and the 61.8% Fibonacci extension at 0.93178 potential targets for the bears.

EUR/CHF: Daily Chart