- Ethereum price plunged by over 13% from Thursday's high. The decline is a ripple effect from the ongoing sell-off observed in Wall Street.

Ethereum price plummeted by 13.10% from Thursday’s intraday high of $3,280.72. The recorded nosedive is comparable to that of other cryptocurrencies.

Bitcoin, the top-ranking cryptocurrency by way of market capitalization, has fallen by close to 8% over the past 24 hours according to CoinMarketCap. As is often the case, BTC tends to shape the path for altcoins. Indeed, altcoins like Ripple, Solana, and Dogecoin are on a similar trajectory.

The plunge was triggered by the heightened downward momentum in Wall Street. Since the beginning of the week, Nasdaq has dropped by about 4%; extending the month’s losses. Over a span of three-and-a-half weeks, the index has plunged by over 10%. Similarly, S&P 500 has been in the red for 5 out of 6 of sessions since mid-last week.

Cryptocurrencies have been embraced as a hedge against inflation. However, as the Federal Reserve works towards tightening its monetary policy, digital assets like Ethereum will likely remain under pressure. At the moment, investors are keen on the Fed interest rate decision scheduled for the coming week.

Ethereum price prediction

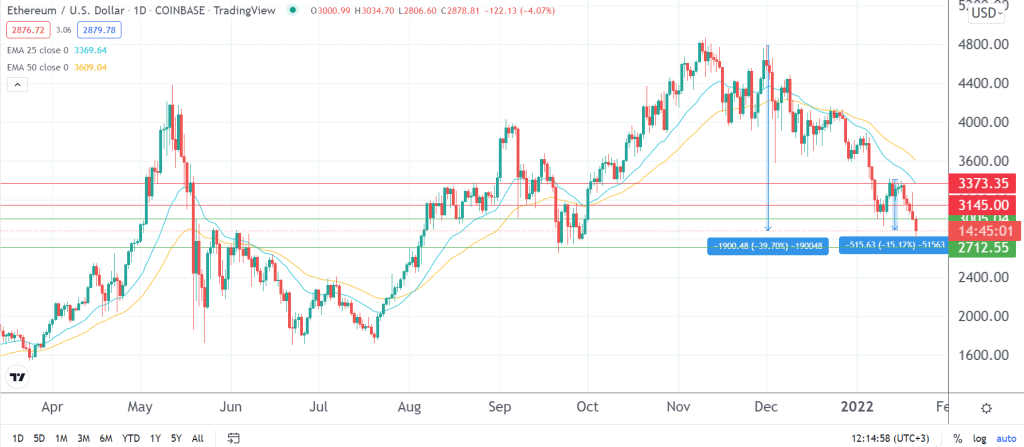

Since the beginning of December, ETH has fallen by 39.70%. On Friday, it extended losses from the previous session; recording a week’s decline of over 15%. Granted, it has since bounced off Friday’s intraday low of 2,813.52. As at 09:00 a.m GMT, the leading altcoin was at 2,890.89.

On a four-hour chart, it is below the 25 and 50-day exponential moving averages. A look at the fundamentals and technicals points to the continuation of the bearish outlook in the ensuing sessions.

I expect Ethereum price to bounce back above the support zone of 3,000, which has been a crucial level for the crypto since early August 2021. Past that level, the bulls will be eyeing the next target, which is along the 25-day EMA at 3,373.35. However, there need to be enough bullish momentum to push it past the resistance level at 3,145.00. On the flip side, it may remain below 3,000 in the near term while finding support at 2,712.55.