- Summary:

- Ethereum price has moved sideways in the past few days. ETH has stalled at around $4,000 level. What next?

Ethereum price has moved sideways in the past few days. ETH has stalled at around $4,000 level, meaning that it has crashed by about $800 from its all-time high. Its total market cap has declined to about $473 billion.

What is the Wash Sale Rule?

There are several reasons why the Ethereum price has retreated. The most important one is the Federal Reserve, which has hinted that it will turn a bit aggressive in the coming year. It has already increased the size of its asset tapering and hinted that it will implement three rate hikes in 2022. Investors in risky assets like cryptocurrencies and high-growth stocks are not a fan of high rates.

Another possible reason why ETH price has retreated in the past few weeks is about taxes. See, Ethereum and other cryptocurrencies have had a spectacular rally this year. They have outperformed stocks and other assets like gold and bonds.

This is where the Wash Sale Rule comes in now that cryptocurrencies have declined recently. The rule limits the use of tax-loss harvesting among investors. It works like this. If a stock that you hold declines, you can sell it and offset these losses from your taxes. When the Wash Sale rule applies, your tax benefits will erode if you move back and buy the same stock or one that is similar to it.

The Wash Sale rule is notable simply because it does not apply to cryptocurrencies. It only applies to stocks and exchange-traded funds (ETFs). Indeed, the Biden administration has proposed bringing the rule to the cryptocurrency industry. The bill anticipates that this rule will net the government about $16.8 billion.

Ethereum Price prediction

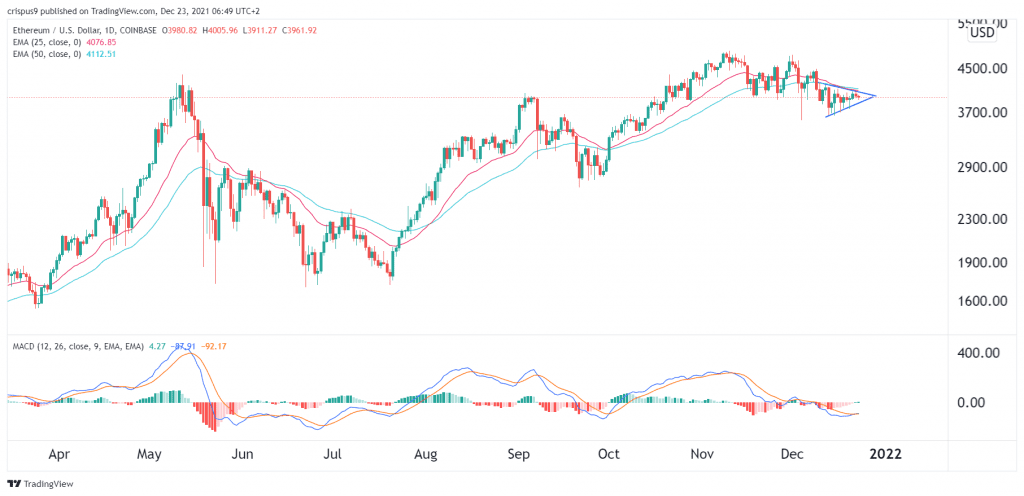

The daily chart shows that the ETH price has been in a tight range in the past few weeks. The coin has struggled to move below the key support at $3,600. It has also struggled moving above the key resistance level at $4131.

A closer look shows that the two lines of the MACD have made a bullish crossover while the 25-day and 50-day moving average have made a bearish crossover. The coin also seems like it has formed a bearish pennant pattern.

Therefore, while the long-term outlook of Ethereum price is bullish, we can’t rule out a situation where it breaks out lower to about $3,500 in the near term. This view will be invalidated if it moves above $4,200.