- Summary:

- What is the outlook of Ethereum price after falling in the past few sessions? We explain what to expect in the near term.

Ethereum price erased its gains on Thursday as cryptocurrency prices suffered a harsh reversal ahead of the upcoming American consumer inflation data. The coin is trading at $2,590, lower than Wednesday’s high of $2,790. Subsequently, its total market capitalization has dropped to about $311 billion, meaning that investors have lost over $200 billion in the past few months. Its peak market cap was $548 billion.

There are several factors that are affecting the prices of Ethereum and other cryptocurrencies. First, the ongoing crisis in Ukraine has led to substantial challenges globally as commodity prices have jumped while stocks have fallen. The coin’s decline today coincides with another drop in American shares. Futures tied to the Dow Jones and Nasdaq 100 indices have fallen on Thursday.

Second, there are concerns about what central banks will do during this crisis. Most analysts believe that key central banks like the Fed and European Central Bank (ECB) are in a fix. In normal times, the idea of tightening would be obvious considering that inflation has jumped to record levels while the unemployment rate in the US and EU have dropped.

The challenge is that tightening monetary policy now means that there will be significant risks to the economy. For one, inflation is at elevated levels and supply chain challenges are continuing. Hawkish central banks will be bad for Ethereum price.

The US will publish its inflation data while the ECB will deliver its interest rate decision. Analysts expect the data to show that inflation surged to 8% while the ECB will embrace a dovish statement.

Ethereum price prediction

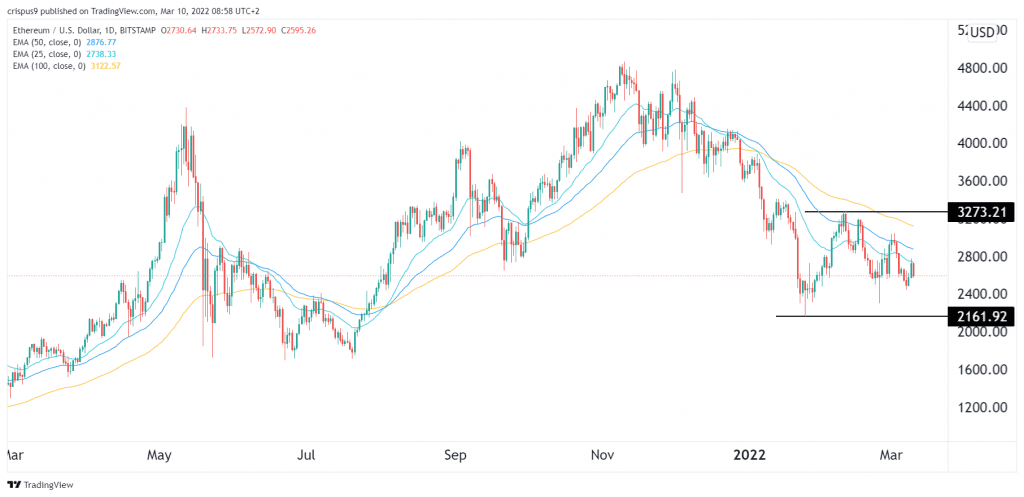

The daily chart shows that the ETH price has been in a tight range in the past few days. The coin has found substantial support at $2,160 and resistance at $3,273. A closer look shows that it has formed what looks like a head and shoulders pattern, which is usually a bearish sign. The downward trend is also being supported by the 25-day and 50-day moving averages. It is also below the 100-day MA.

Therefore, Ethereum price will remain in a bearish trend until it moves above the three MAs. Before then, the outlook remains bearish, with the next key support level being at $2,160.