- Ethereum price prediction might look bearish from the TA perspective. However, another major upwards push is expected before the ETH Merge.

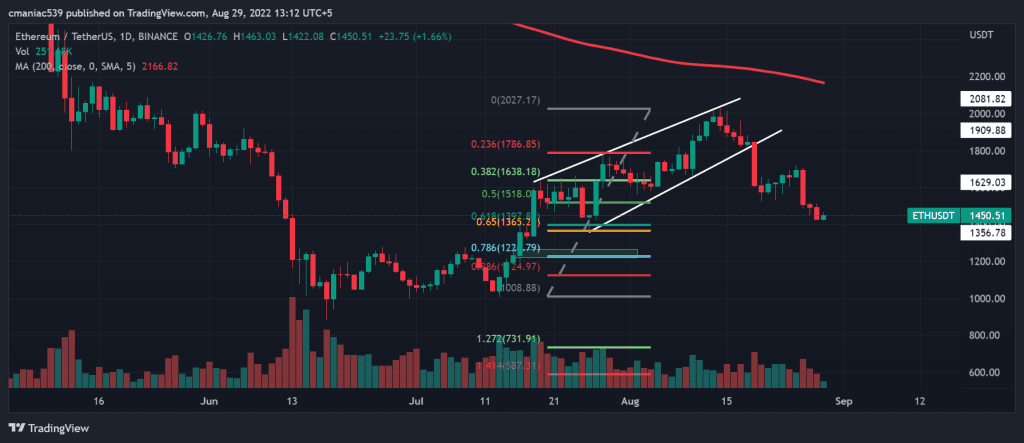

As mentioned in our last Ethereum price prediction, the price is on its way to dropping into the Fib golden region of $1365-$1400. The falling wedge breakdown is playing out perfectly since the ETH price broke below the channel. The last week’s hawkish comments by the FED chair Jerome Powell further increased the selling pressure.

After a few weeks of positive price action, it seems like the crypto relief rally is finally over. This rally was fuelled by the decreasing July CPI numbers and the upcoming Ethereum Merge upgrade. ETH crypto price soared by almost 140% from its June 2022 lows in anticipation of the big upgrade. However, the bulls failed to break above the psychological barrier of $2000.

At the time of writing, Ethereum price is trading at $1454. The price has risen by 1.8% so far during Monday’s trading session. On the higher timeframe, the price is still 70% down from its November 2022 all-time high of $4,878. Nevertheless, with the Ethereum 2.0 upgrade on the horizon, another leg up is still on the cards in the first 2 weeks of September.

According to Ethereum news, the protocol’s transition from PoW to PoS could happen as soon as the 13th of September. The difficulty target TTD has been set to 58750000000000000000. Due to the network dynamics and minor fluctuations in block time, the actual date might vary by a couple of days.

Ethereum Price Prediction

Not much has changed on the ETH USD chart since our last week’s analysis. The price is on its way to meeting the falling wedge breakdown target of $1365, which also aligns with the 0.65 Fib level. There’s also a chance of the price bouncing off the 0.618 Fib level that lies at $1397. A daily closure below this level would be very bearish for the native asset of the top smart contract platform.

Ethereum price prediction might look bearish from the TA perspective. However, considering the price action of most cryptocurrencies around major events, another bullish leg for ETH is still on the horizon. In such a scenario, the price could target the $1800-$2160 region before the major transition event.

The invalidation of this move would be a stop loss below the $1230 level, which could be the final nail in the coffin. You can trade this setup on spot or derivatives by signing up on top exchanges like Binance, BYBIT and Kucoin.

Ethereum Daily Chart