- Summary:

- Although many crypto analysts predict the Ethereum price will reach $5,000 soon. In reality, $3,200 is likelier in the current climate.

Although many crypto analysts predict the Ethereum price will reach $5,000 soon. In reality, $3,200 is likelier in the current climate.

Ethereum (ETH) has dropped 10% in the last 24-hours as nervous longs take money off the table ahead of today’s critical US inflation data. Risk assets could be in for a bumpy ride if the Core CPI release later today is in line with the forecast 0.5% MoM. In that event, the Fed will almost certainly bring forward the timeline for reducing asset purchases. Considering that many investors view Bitcoin and Ethereum as inflation hedges, logic suggests tightening central bank policy will harm prices. Furthermore, the large volume of long positions built up by investors expecting a ‘Santa rally’ could exacerbate the selling if the Ethereum price turns lower.

Despite the potential headwinds, ETH has held up relatively well compared to BTC. While the market leader is down 30% from last month’s all-time high, Ethereum is just 16% below its record price. However, the outperformance could curse the longs if a liquidation event occurs. In my opinion, the trigger could come if the price closes below the trend line support at $3,850, just 6.3% below the current price.

ETH Price Analysis

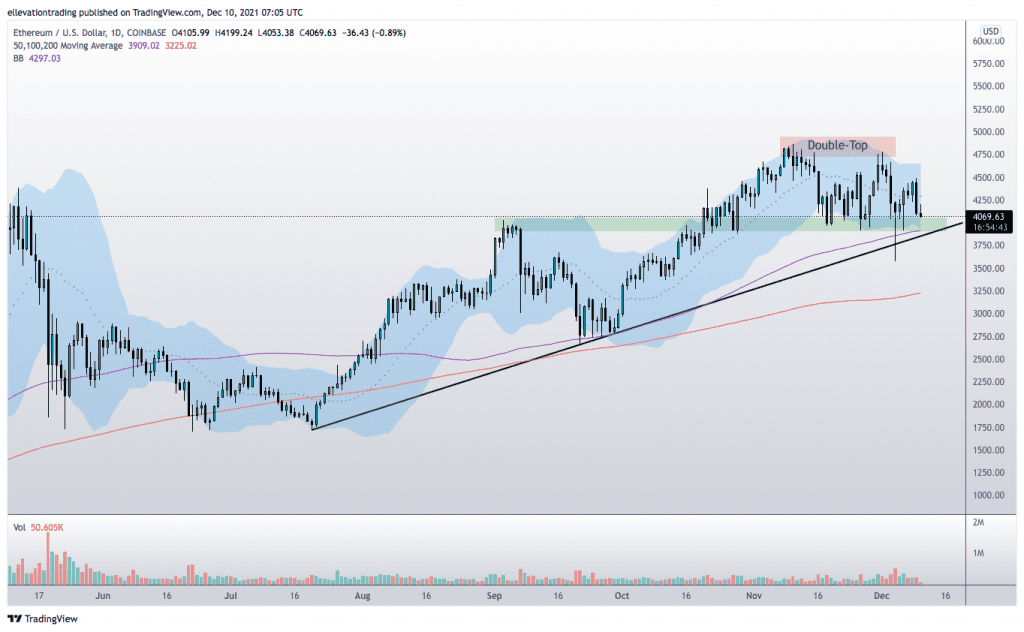

The daily chart shows the Ethereum price is approaching several critical support levels. The first is the 100-Day Moving Average at $3,908, aligning with a series of lows and the September highs. While the 100 DMA is significant, I consider the rising trend line at $3,850 crucial.

If ETH posts a daily close below the trend, I expect an extension towards the 200-DMA at $3,225. In contrast, a broader market risk-off could push ETH as low as $2,600 (September low).

My base case for Ethereum is $3,200, taking into account potential central bank responses to inflation and the extreme positioning. However, a close above yesterday’s high would be technically constructive. Therefore, a close above $4,500 invalidates the bearish thesis.

Ethereum Price Chart (Daily)

For more market insights, follow Elliott on Twitter.